News and Announcements

The “Crypto Cycle” is Dead. The Infrastructure Era is Here.

- Published December 18, 2025 3:35AM UTC

- Publisher Steve Torso

- Categories Capital Insights, Landing, Trending

If you have been following the digital asset market in 2025, you have noticed a distinct shift. The market is no longer behaving according to the rules of the last decade.

The traditional “4-year Halving Cycle” that traders relied on appears to have broken. The parabolic retail frenzy didn’t materialise on schedule. Bitcoin behaved less like a speculative outlier and more like a mature macro asset.

Many are calling this a failure of the cycle. I view it differently.

This is a maturation.

We are witnessing the transition from the era of speculation to the era of institutionalisation. While retail investors waited for an “alt-season”, the smart money was quietly building the rails for the future of finance.

Here are the three structural forces converging to define 2026.

1. The Macro Liquidity Wave: Governments globally are facing a massive refinancing wall. Over $9 trillion in US debt alone will mature in 2025. History tells us that this level of debasement inevitably drives capital into hard assets.

Institutional allocators are now viewing Digital Assets not just as a trade, but as a necessary hedge against fiscal fragility. The narrative has shifted from “profit seeking” to “value preservation”.

2. The Rise of Real World Assets (RWA): BlackRock and major institutions are not interested in meme coins. They are building tokenised funds (like BUIDL) and moving Treasuries, private credit, and property on-chain.

This is the bridge between TradFi and DeFi. It is a market projected to reach trillions by 2030. The focus is on yield, utility, and efficiency, not hype.

3. Stablecoins as Global Rails: Stablecoins have quietly become the “engine room” of the new economy.

They processed $46 trillion in transaction volume last year. We are approaching Visa-scale settlement, and now Visa itself is settling in USDC. BCG projects this market to reach $16 trillion by 2030.

Stablecoins are no longer just for trading. They are becoming the settlement layer for global commerce.

The Strategic Pivot

The question for 2026 isn’t “When is the bull run?”

The question is: “How do I position for the institutional migration?”

The rules have changed. The cycle has evolved. Your strategy must evolve with it.

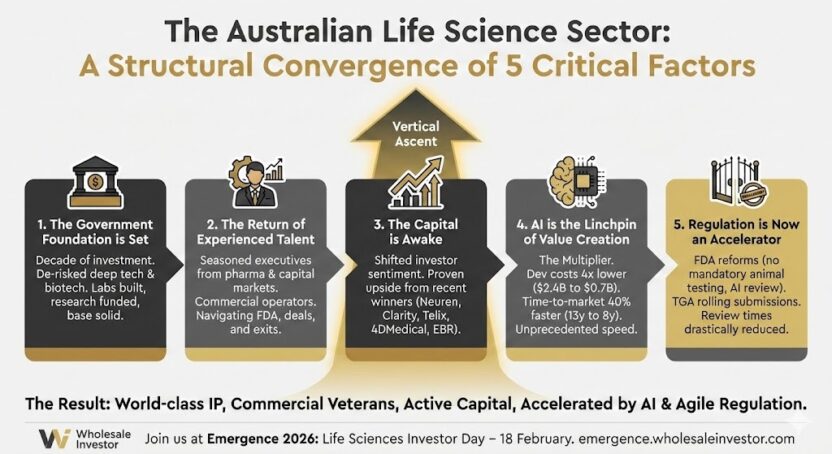

This convergence of Traditional Finance and Web3 is a headline theme at Emergence 2026 (Feb 19-20, Sydney). We are gathering the fund managers, infrastructure builders, and institutional allocators who are driving this shift.

At Emergence, you will gain access to:

- Institutional Insights: How Family Offices are structuring exposure for this new cycle.

- RWA Opportunities: The platforms successfully tokenising real-world yield.

- High-Value Networks: The investors who understand that the future of finance is being built right now.

The narrative has shifted from “Halving” to “Integrating”. Emergence is where you meet the people building the integration.

Trending

Backed By Leading Investment Groups and Family Offices