News and Announcements

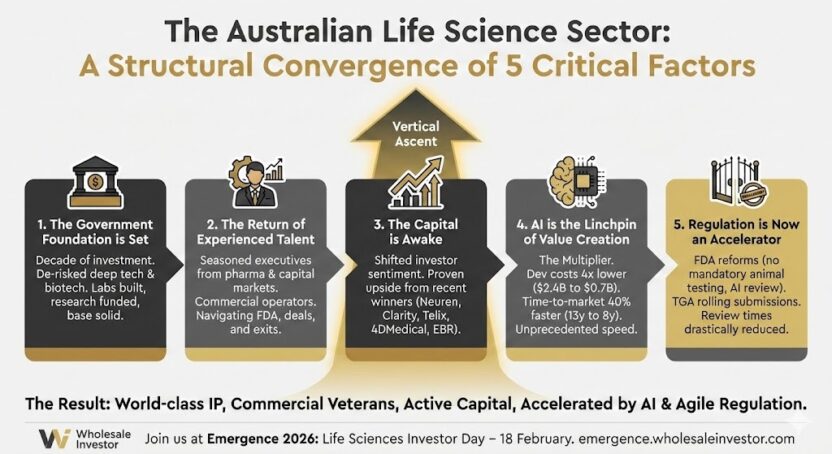

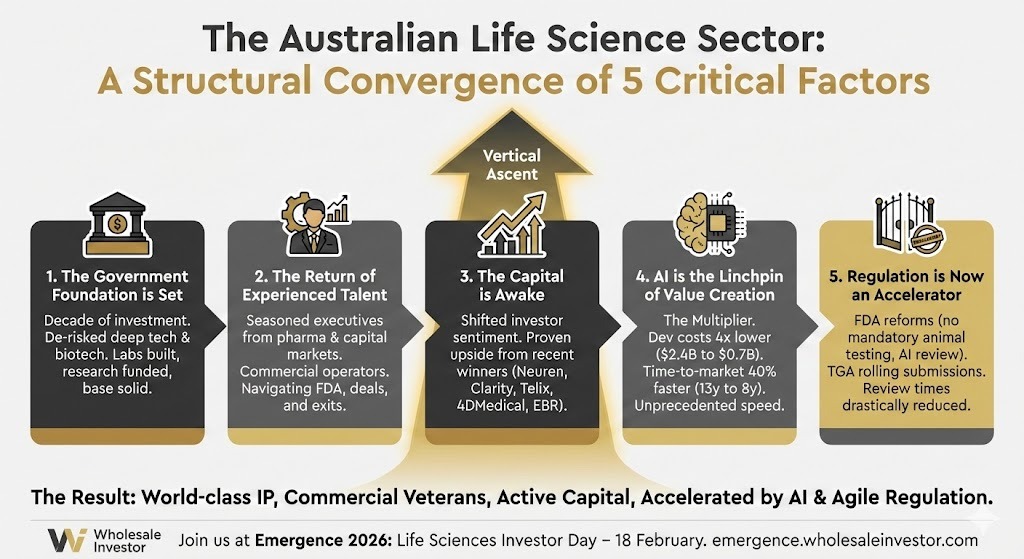

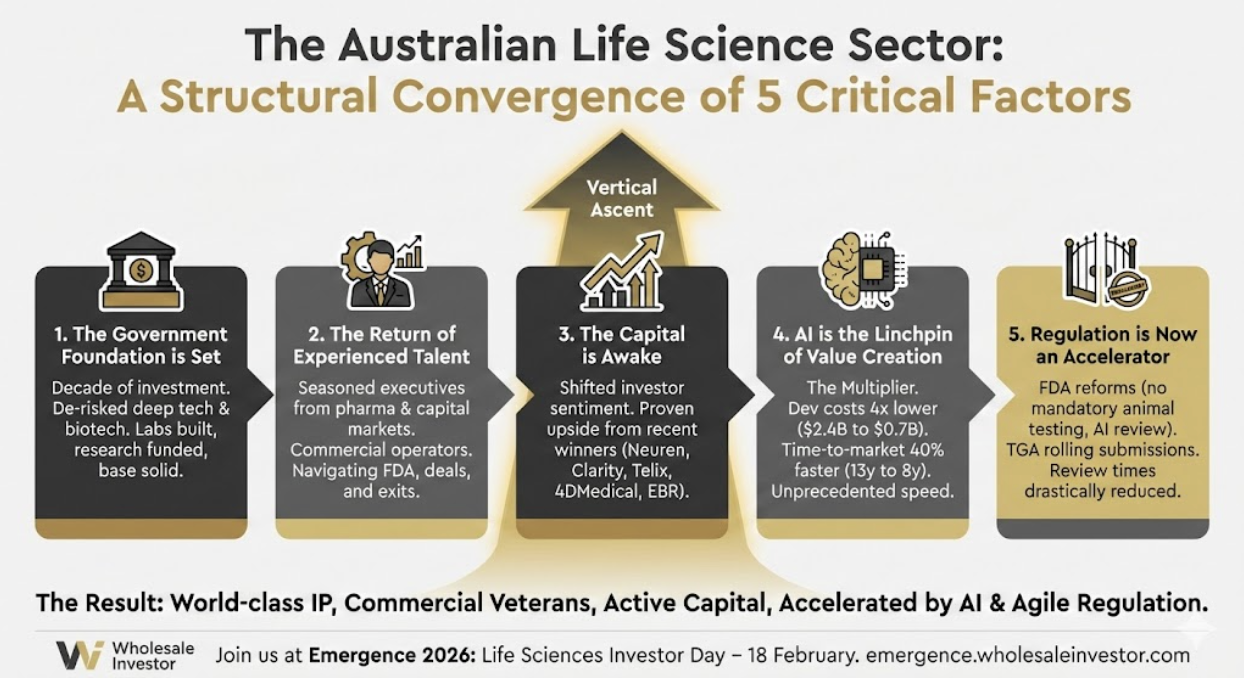

The Australian Life Science Sector: A Structural Convergence of 5 Critical Factors

- Published February 16, 2026 8:50AM UTC

- Publisher Steve Torso

- Categories Capital Insights, Company Updates, Events, Trending

For a decade, we have watched the foundation being built.

Government grants are flowing into research infrastructure. Labs constructed. IP portfolios are growing. Talent returning from global pharma.

For most of that decade, the returns were slow, the timelines were long, and the capital was cautious.

That era is over.

The Australian life science sector has reached a tipping point. Not because of a single breakthrough or a single company, but because 5 structural forces are converging at the same time. Each one is powerful on its own.

Together, they are creating what I believe is the highest conviction investment opportunity in the Australian market today.

This is why we are opening Emergence 2026 with the Life Sciences Investor Day on 18 February. And this is why I want to lay out the full thesis.

The Australian Life Science Paradox

Australia is in the top tier globally for research and innovation. World-class IP. Groundbreaking discoveries. Brilliant teams across our universities and research institutes.

But the path to capital has been incredibly challenging.

A very small number of local VCs are active in this space. This has created a structural funding gap, particularly in development, clinical trials, and early commercialisation.

Outstanding science. Insufficient capital pathways.

What is changing now is that all five forces are closing that gap simultaneously. The opportunity for investors who understand this convergence is significant.

Factor 1: The Government Foundation is Set

This is the part of the story most investors overlook because it happened gradually. The cumulative effect is enormous.

Over the past decade, Federal and State governments have committed to an aggressive investment strategy in life sciences and deep tech.

An incredible range of grants and funding programs for investment, innovation, and expansion offshore. Strong research capacity across universities and research institutes. And a significant pool of executives actively looking to support innovative life science and MedTech companies.

The labs are built. The research is funded. The base is solid.

For investors, this means the early-stage risk that historically made life sciences a difficult asset class has been substantially de-risked. The government has effectively underwritten the foundational layer of the ecosystem.

The IP is no longer theoretical. It is developed, validated, and in many cases ready for commercialisation.

This is the platform on which everything else is being built.

Factor 2: The Return of Experienced Talent

Capital means nothing without execution.

This has always been the bottleneck for Australian life sciences. Outstanding science, but not enough commercial operators who know how to take that science to market.

That is changing fast.

We are seeing seasoned executives with deep expertise in pharmaceuticals and capital markets stepping in to lead these companies. These are not just scientists. They are commercial operators who know how to navigate the FDA, structure deals, build regulatory strategies, and deliver exits.

This is the difference between a research project and an investable company.

When you combine world-class IP with executives who have built and sold pharma businesses globally, you get something investors can underwrite with confidence.

The talent pipeline is no longer a weakness. It is becoming a competitive advantage.

Factor 3: The Capital is Awake

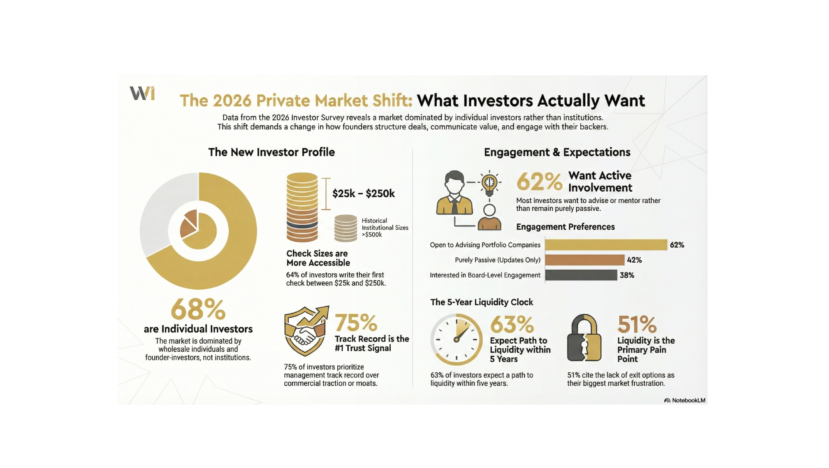

Our 2026 Investor Survey tells the story clearly.

31% of investors are actively focused on Life Sciences and BioTech. 32% on HealthTech and MedTech. 37% on Deep Tech including AI, robotics, quantum, and space, much of which intersects directly with life sciences.

These are not speculative numbers. These reflect the actual allocation intentions of sophisticated and wholesale investors across our network.

The data goes deeper than sector preference.

When we asked investors about personal conviction and cause alignment, the results were striking:

42% identified AI and its exponential potential as their primary focus. 33% pointed to food security and agriculture. 27% to aging, longevity, and elder care. 13% to chronic illness and rare disease.

This tells us something important. Investors are not just chasing returns in life sciences. They are personally motivated by the outcomes. That combination of financial upside and personal conviction creates a very different kind of capital. It is stickier. More patient. More aligned with the long development cycles that life sciences companies require.

Then there is the proof of concept.

Neuren, Telix, Clarity Pharmaceuticals, 4DMedical, and EBR Systems have demonstrated that Australian life science companies can achieve unicorn status. These are not theoretical case studies. They are companies that raised capital, built commercial businesses, and delivered significant returns.

The capital is not just awake. It is actively positioning.

Factor 4: AI is the Linchpin of Value Creation

This is the multiplier. And it changes the entire risk profile of life sciences investing.

AI-driven drug discovery is reducing development costs by 4-fold, from $2.4 billion to $700 million. It is cutting time-to-market by 40%, from 13 years to 8 years.

These are not incremental improvements. They represent a fundamental restructuring of the economics of drug development.

AI’s impact goes far beyond drug discovery.

Rapid prototyping through AI, simulation tools, and 3D printing has dramatically reduced development costs and timelines for medical devices. Autonomous labs are running thousands of experiments in parallel. Protein structures are being predicted in hours, not years. New biomaterials are being designed computationally before they ever reach a physical lab.

Healthcare is fundamentally shifting from reactive to proactive. AI-assisted diagnostics and personalised medicine are reaching commercial stage.

The big tech players see this clearly.

In January 2026, OpenAI launched ChatGPT Health with 230 million users asking health questions weekly, integrated with medical records and wellness apps. Their HIPAA-compliant suite is deployed across six major US health systems including Memorial Sloan Kettering and Stanford Medicine.

Anthropic launched Claude for Healthcare and Claude for Life Sciences, covering clinical trial management and regulatory operations.

Google DeepMind’s Isomorphic Labs has 17 drug projects across cancer, cardiovascular, and immunology, with their first clinical trial expected by end of 2026.

The market momentum is undeniable. $2.7 billion was invested in AI drug development in just the first three quarters of 2025. 63% of healthcare professionals are actively using AI today.

For investors, this means the companies presenting at our Life Sciences Investor Day are operating in a completely different environment than five years ago. The capital required to reach key milestones is lower. The timelines are shorter. The probability of commercial success is higher.

AI is not a feature of these companies. It is the engine making the entire sector investable at scale.

Factor 5: Regulation is Now an Accelerator

This is the factor most investors still get wrong.

For decades, regulation was viewed as a handbrake on life sciences. Long approval timelines. Expensive compliance. Uncertain pathways that could add years to commercialisation.

That narrative is now changing.

New FDA reforms are fundamentally changing the equation. The removal of mandatory animal testing for certain pathways. National Priority Vouchers that fast-track critical therapies. AI-assisted reviews are reducing review times from years to months.

In Australia, the TGA has introduced rolling submissions and accelerated pathways for priority medicines. Review times have been drastically reduced.

Combine these regulatory reforms with the 40% time-to-market compression from AI, and the entire risk profile transforms.

What used to be a 13-year, $2.4 billion journey to market is becoming an 8-year, $700 million pathway. The regulatory gates that used to add years of uncertainty are becoming structured, predictable processes.

For sophisticated investors, this changes the calculus entirely. The same quality of science. Better management teams. Lower capital requirements. Faster timelines. And a regulatory environment actively working to accelerate approvals rather than slow them down.

The Convergence

Any one of these five factors would be noteworthy on its own.

All five converging at the same time is rare. And it is structural, not cyclical.

The result is a pipeline of world-class IP, led by commercial veterans, backed by increasingly active capital, and accelerated by AI and agile regulation.

Our 2026 Investor Survey confirms that 24% of investors in our network have operational expertise in Healthcare, Pharma, and BioTech. These are not generalist investors dabbling in life sciences. They are professionals who understand the sector deeply and are actively deploying capital.

Why We Are Opening Emergence 2026 with Life Sciences

We built the Life Sciences Investor Day as the opening event of Emergence 2026 because this is the highest conviction opportunity in the market right now.

On 18 February in Sydney, 25 companies across discovery, MedTech, and growth stages will present to a curated audience of investors with genuine sector expertise and active capital.

This is not a general tech showcase. It is a focused, high-signal event designed to connect serious capital with the companies best positioned to benefit from this structural convergence.

The smart money is already positioning. The five forces are aligned. The window is open.

Join us at Emergence 2026: Life Sciences Investor Day on 18 February.

Trending

Backed By Leading Investment Groups and Family Offices