News and Announcements

The $3.5 Trillion Succession Wave: Why 48% of Australian Business Owners Are About to Destroy Value

- Published January 27, 2026 3:00PM UTC

- Publisher Bella Battsengel

- Categories Capital Insights, Trending

Australia’s Largest Wealth Transfer Has No Exit Plan

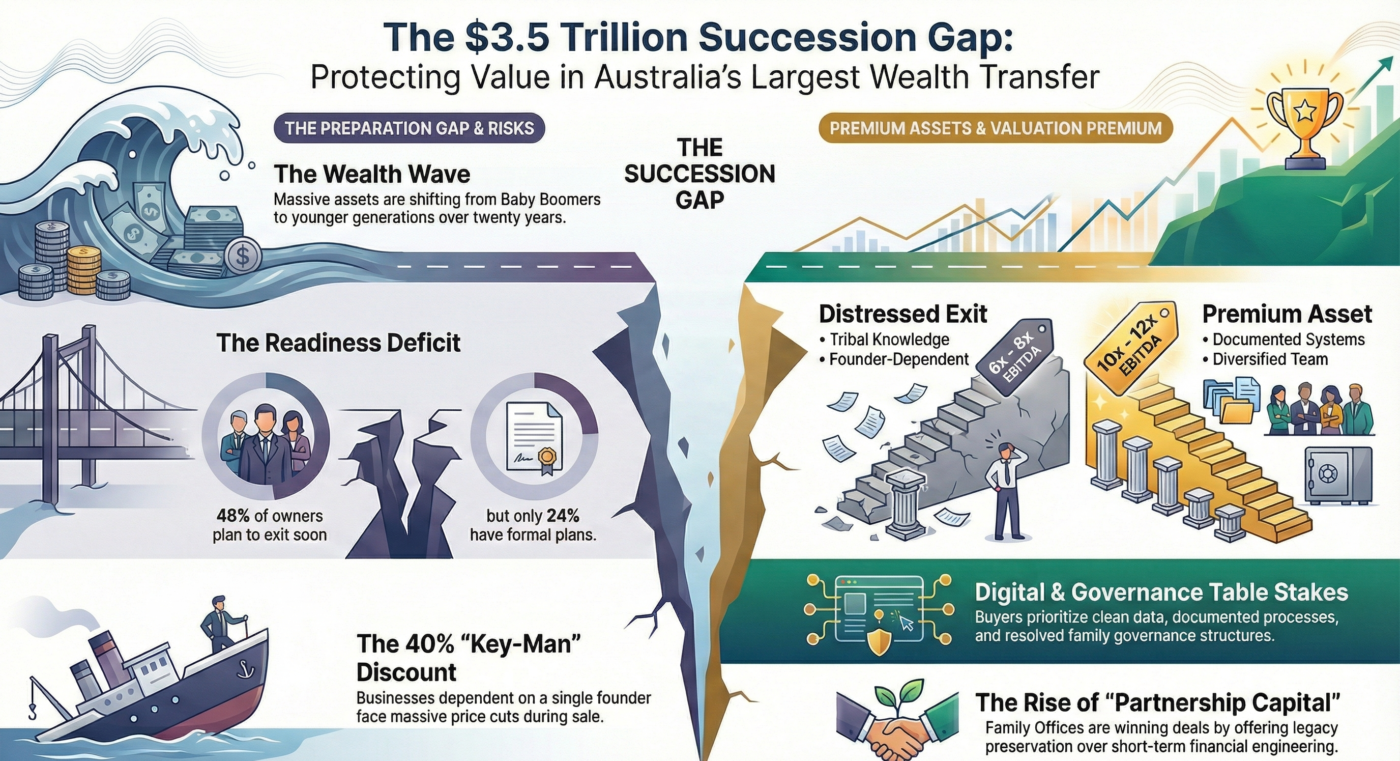

Australian business succession planning is broken. An estimated $3.5 trillion in assets will pass from Baby Boomers to younger generations over the next two decades.

The numbers reveal a crisis. 48% of Baby Boomer business owners plan to exit within five years. Only 24% have formal succession plans.

This creates opportunity for prepared buyers. For unprepared sellers, this means value destruction.

Premium Assets vs. Distressed Exits

Australian business succession creates two distinct categories.

Premium Assets Trade at 10x-12x EBITDA

Premium assets have clean governance. They have documented processes. They have digital infrastructure. They have resolved family dynamics.

These businesses command strategic multiples.

Distressed Exits Trade at 6x-8x EBITDA

Distressed exits have founder dependency. They rely on tribal knowledge. They have unqualified family members in key roles. They lack institutional-grade systems.

These businesses face steep discounts.

The pricing gap is widening. Australian business succession planning determines which category you fall into.

Three Valuation Killers in Business Succession

1. Key-Man Risk (30-40% Discount)

Key-man risk destroys business valuations. If the founder controls all customer relationships, the business cannot sell at premium multiples.

Australian business succession planning requires 3-5 years of preparation. Hire a management team. Document all processes. Step back from daily operations.

This proves the business runs without the founder.

2. Digital Infrastructure Gap

Modern buyers expect clean data infrastructure. They want AI deployment capability. They need integrated systems.

Businesses with modern ERP systems command premiums. Businesses running on spreadsheets trade at discounts.

Digital readiness is now essential in Australian business succession planning.

3. Family Dynamics Risk

Unresolved family conflicts kill deals. Buyers identify these issues during due diligence.

Family members in roles based on relationships rather than qualifications create valuation risk. Unclear decision-making authority creates deal uncertainty.

Formal family governance structures signal sophistication.

Why Family Offices Win Premium Acquisitions

Family offices operate differently than private equity. They use permanent capital. They hold assets for 15-20 years. They preserve legacy while funding growth.

This matters in Australian business succession planning.

The Partnership Capital Advantage

Founders care about legacy. They want their business protected after exit. They value alignment over maximum price.

Family offices offer this. Private equity funds cannot.

Australian business succession increasingly favors family office buyers.

Direct Investment Growth

Family offices now represent 40% of active private capital investors in Australia. They invest directly. They co-invest with trusted partners. They select assets aligned with their values.

This is structural change in Australian business succession planning.

Sector Shifts in Australian Private Capital

Family offices are reallocating capital into four key sectors.

- Technology. Recurring revenue businesses that compound over decades.

- Energy Transition. Critical minerals and renewable infrastructure with multi-decade horizons.

- Healthcare. Preventative care and AI-enabled diagnostics aligned with impact goals.

- Private Credit. Senior secured lending in higher interest rate environments.

Patient capital wins in these sectors.

The Generational Philosophy Divide

Baby Boomers built businesses focused on cash flow preservation. They optimised for stability. They avoided risk.

Millennials and Gen Z approach investing differently. They prioritise impact. They embrace technology. They accept higher risk for higher growth.

This creates valuation mismatches in Australian business succession planning. Sellers expect buyers to value current operations. Buyers value transformation potential.

Understanding this gap is critical.

ASIC’s Warning on Semi-Liquid Funds

Semi-liquid private equity funds promise monthly or quarterly liquidity. They target high net worth investors with $25,000-$100,000 minimums.

ASIC warns of liquidity mismatch. When markets decline, redemption gates close. Investors get locked in.

Treat these as illiquid despite marketing claims.

The Succession Readiness Audit

Buyers now conduct succession readiness audits. They evaluate five factors.

- Management capability. Can the team scale without the founder?

- Process documentation. Are systems documented or tribal?

- Customer concentration. Are relationships diversified or founder-dependent?

- Digital infrastructure. Modern systems or legacy platforms?

- Family governance. Clear structures or ambiguous authority?

Passing this audit means strategic multiples. Failing means steep discounts.

Strategic Actions for 2026

Australian business succession planning requires immediate action.

For Family Offices

Build direct investment teams. Establish partnership capital reputation. Target premium assets with clean governance.

For Business Owners

Start succession planning 3-5 years before exit. Invest in management development. Upgrade digital infrastructure. Resolve family governance.

Preparation earns 10x-12x EBITDA. Avoidance gets 6x-8x EBITDA.

For Advisors

Educate clients on valuation gaps. Unprepared assets face brutal price discovery. The market rewards preparation.

Partnership Capital Creates Competitive Advantage

The $3.5 trillion wealth transfer creates opportunity. Smart capital providers understand succession psychology.

Exiting founders want certainty. They want value alignment. They want confidence their business survives them.

Family offices offering partnership capital win deals. They provide longer hold periods. They offer flexible structures. They preserve legacy.

This reputation compounds. Premium deal flow follows.

Australian business succession planning favors relationship-driven capital.

The Market Separates Winners from Losers

Premium assets with succession plans command 10x-12x EBITDA. They attract family offices paying for certainty.

Distressed exits with key-man risk trade at 6x-8x EBITDA. They face steep discounts or no buyers.

Australian business succession planning determines outcomes. Preparation creates value. Avoidance destroys it.

The $3.5 trillion is moving. The market has already separated categories.

Which one are you in?

#FamilyOffice #BusinessSuccession #WealthTransfer #PrivateEquity #AustralianBusiness #SuccessionPlanning

Trending

Backed By Leading Investment Groups and Family Offices