News and Announcements

The $210 Billion Secondary Market: Why Private Equity’s Third Exit Just Became Mainstream

- Published January 29, 2026 12:00PM UTC

- Publisher Bella Battsengel

- Categories Capital Insights, Capital Raising Tips, Trending

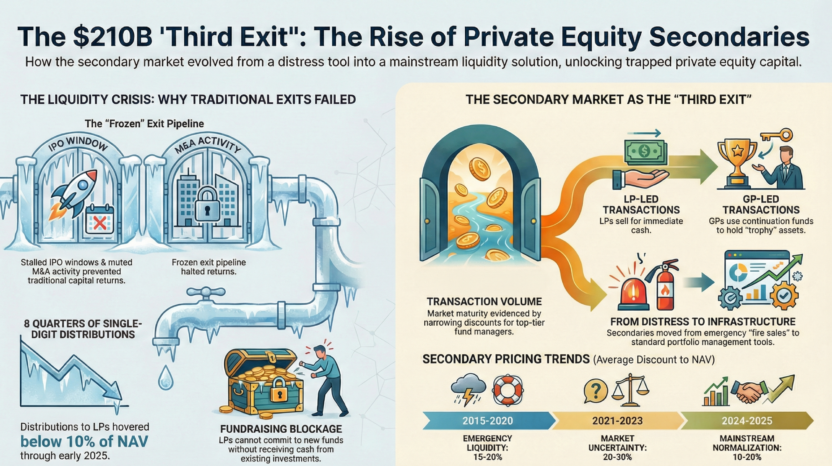

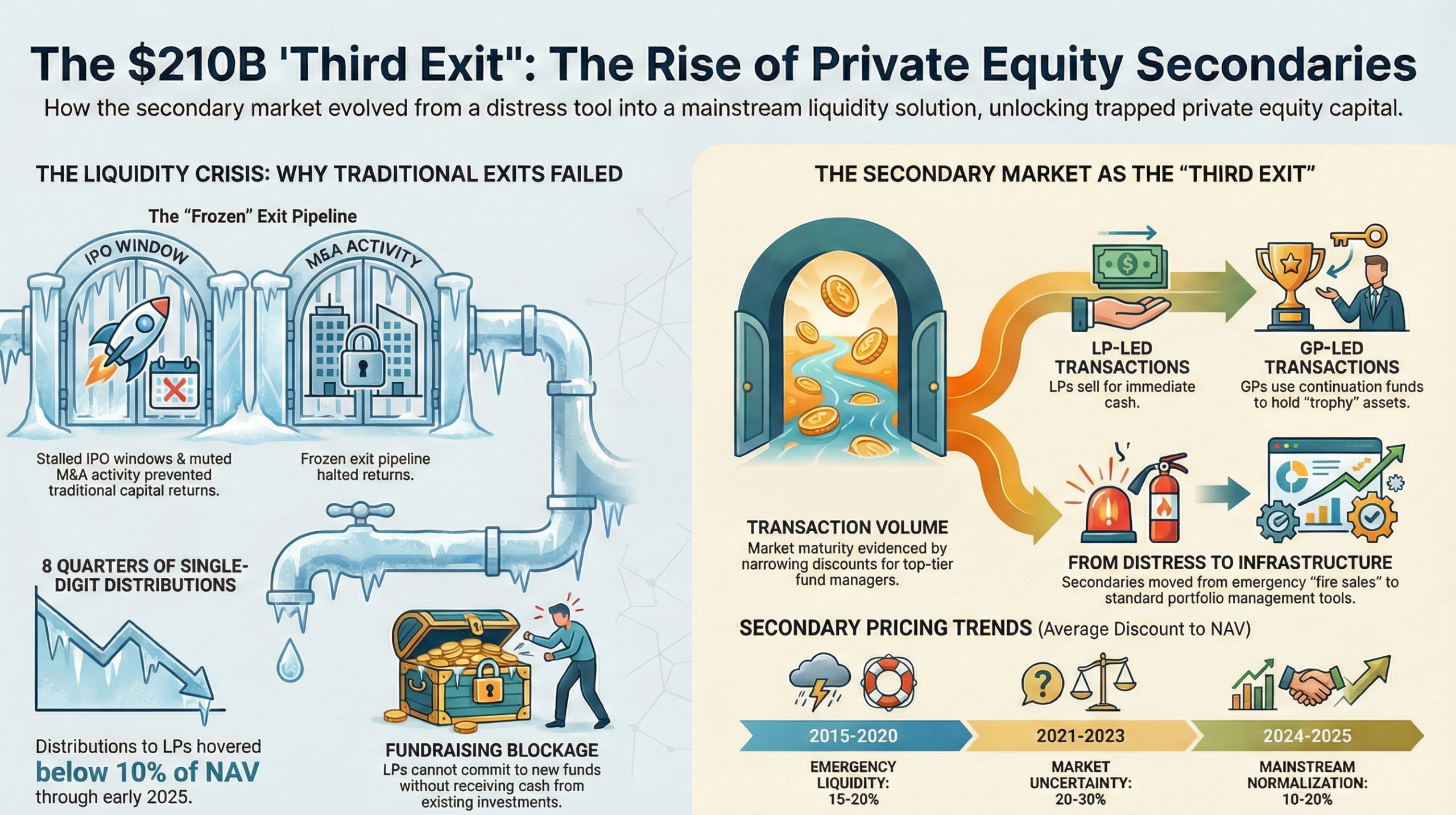

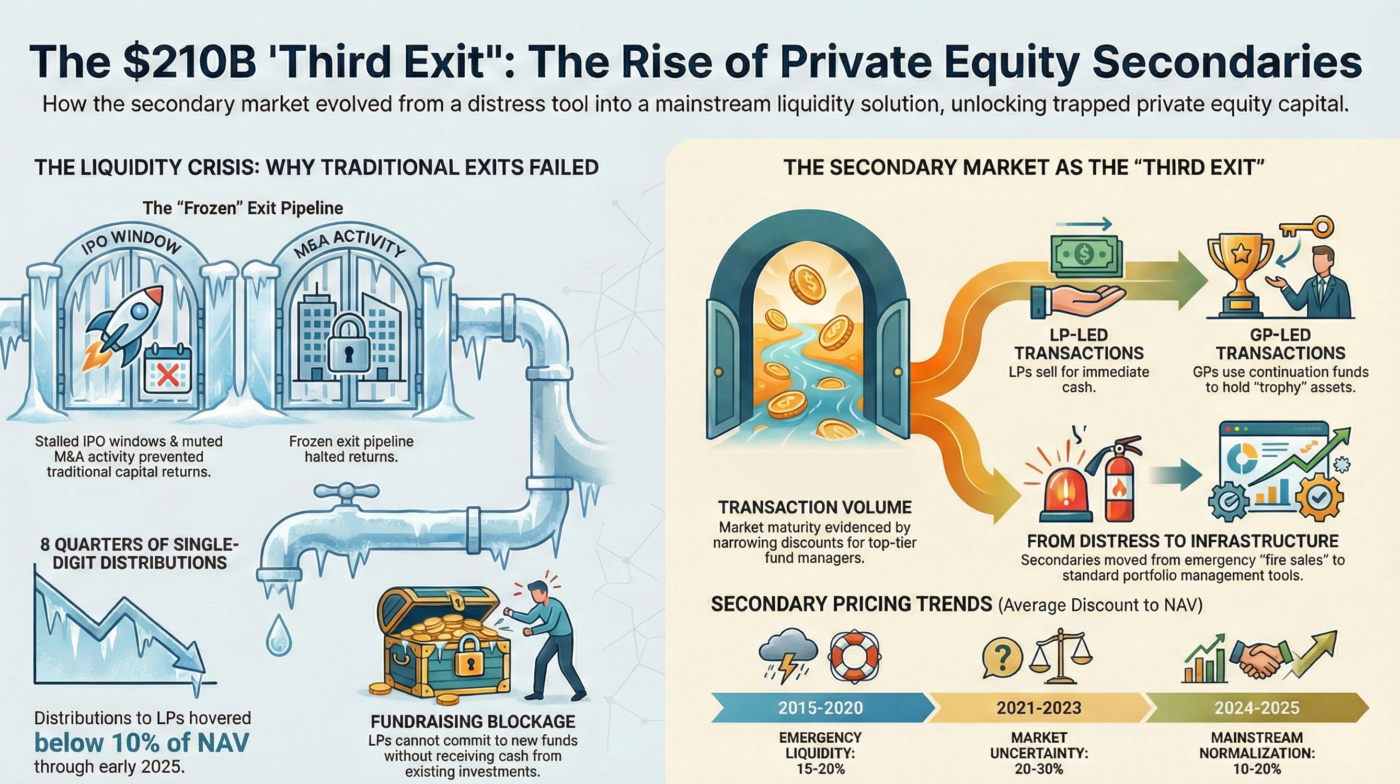

The Liquidity Crisis That Changed Everything

The private equity secondary market crossed $210 billion in transaction volume in 2025. This represents a fundamental shift in how limited partners access liquidity.

For eight consecutive quarters, distributions to LPs hovered in single digits as a percentage of NAV. This matched levels last seen during the Global Financial Crisis.

The IPO window remained frozen through early 2025. M&A activity stayed muted. Traditional exit pathways failed to return capital to investors.

The private equity secondary market evolved from emergency liquidity mechanism to core portfolio management infrastructure. This is structural change, not temporary adaptation.

From Distress Tool to Standard Infrastructure

Historically, the private equity secondary market served one function. Distressed sellers liquidated positions at steep discounts when they needed cash urgently.

This stigma no longer exists.

The Evolution Timeline

2015-2020: Secondary transactions represented emergency liquidity for LPs facing capital calls or portfolio rebalancing needs. Pricing discounts averaged 15-20% to NAV.

2021-2023: The exit pipeline froze. Companies delayed IPOs. M&A dried up. LPs accumulated unrealized gains with no distribution timeline.

2024-2025: Secondaries became normalized. GP-led continuation funds launched regularly. LP-led transfers occurred at narrower discounts. Institutional buyers entered the market at scale.

The private equity secondary market is now the “third exit” alongside IPO and M&A.

Why Distributions Collapsed to Crisis Levels

Limited partners measure fund performance through DPI (Distributions to Paid-In Capital). This metric shows actual cash returned versus capital committed.

For eight consecutive quarters through 2025, DPI remained in single digits as a percentage of NAV. This matched distribution rates last seen in 2008-2009.

The Structural Causes

The 2020-2021 vintage overhang. Funds raised massive capital during peak market conditions. Those assets were underwritten at 12x-14x EBITDA multiples. Current market comps trade at 8x-10x EBITDA.

The IPO window closure. Traditional exit pathway remained frozen through Q1 2025. Companies that planned 2022-2023 listings delayed indefinitely.

The M&A slowdown. Corporate buyers pulled back. Strategic acquirers faced their own capital constraints. Regulatory scrutiny increased deal timelines.

Hold period extension. The traditional 3-5 year exit horizon stretched to 5-7 years as GPs held assets longer to “grow into” valuations through earnings rather than multiple expansion.

Limited partners cannot make new fund commitments without receiving distributions from existing vintages. This creates a cyclical blockage in the fundraising market.

The Two Types of Secondary Transactions

The private equity secondary market operates through two distinct transaction structures.

LP-Led Secondaries

Limited partners sell their fund interests to secondary buyers. This provides immediate liquidity to the selling LP while the fund continues operating normally.

Typical pricing: 85-95% of NAV for high-quality funds, 70-85% for middle-market funds.

Motivations: Portfolio rebalancing, liquidity needs, strategic exits from underperforming managers.

Buyers: Dedicated secondary funds, sovereign wealth funds, family offices seeking vintage diversification.

GP-Led Secondaries (Continuation Funds)

General partners transfer trophy assets from older funds into new dedicated vehicles. This provides liquidity to LPs who want to exit while allowing rolling LPs and new investors to hold assets for another 3-5 years.

Typical structure: Existing LPs receive liquidity option or rollover option. New capital enters at reset valuation.

Motivations: Extend hold period for high-quality assets not ready for IPO or M&A exit.

Benefits: Avoids forced exit into unfavorable market conditions while providing partial DPI to existing LPs.

Once viewed with skepticism, continuation funds became accepted standard infrastructure for managing high-quality assets in blocked exit markets.

Why Only 2% of Unicorn Value Historically Traded

Despite the $210 billion volume milestone, the private equity secondary market remains underpenetrated relative to the total market opportunity.

Only approximately 2% of total unicorn market capitalization has historically traded on secondary markets. This indicates massive room for growth.

The Barriers Breaking Down

Information asymmetry. Buyers lacked access to portfolio company performance data. GP cooperation was limited. Pricing discovery was opaque.

Stigma of distress. Selling on secondaries signaled portfolio problems or LP financial stress. This reputational concern prevented transactions.

Limited buyer base. Few institutional investors had dedicated secondary programs. Pricing was inefficient due to limited competition.

GP consent requirements. Limited partnership agreements often required GP approval for LP transfers. This created friction and delays.

These barriers are eroding rapidly. The private equity secondary market is professionalizing.

The Pricing Dynamics: Discounts Are Narrowing

Secondary transaction pricing reflects supply-demand dynamics and perceived asset quality.

Historical Discount Ranges

2015-2020: Average discounts of 15-20% to NAV for quality funds, 25-35% for distressed situations.

2021-2023: Discounts widened to 20-30% as uncertainty increased and buyers demanded larger risk premiums.

2024-2025: Discounts narrowed to 10-20% for top-tier managers as institutional buyers entered and supply-demand balanced.

Pricing compression indicates market maturation. More buyers competing for assets reduces seller discounts.

What Drives Pricing

Manager track record. Top-quartile GPs with strong DPI history trade at narrower discounts.

Portfolio quality. Funds with concentrated positions in high-growth sectors (AI, healthcare, infrastructure) command premiums.

Remaining fund life. More time until fund termination means higher pricing uncertainty and wider discounts.

NAV credibility. Conservative marking policies from GPs result in narrower discounts as buyers trust valuations.

The private equity secondary market is developing price discovery mechanisms comparable to public markets.

Why LPs Are Demanding Secondary Solutions

Limited partners face capital allocation constraints that secondary liquidity directly addresses.

The LP Perspective

Institutional LPs (pension funds, endowments, sovereign wealth) manage to target allocation percentages. Private equity typically represents 8-15% of total portfolio.

When distributions lag, this creates problems. The denominator effect causes private equity allocations to drift above targets as public markets fluctuate.

LPs become “overallocated” to private equity not because they deployed more capital, but because they received no distributions to rebalance.

The Re-Up Problem

General partners rely on existing LPs to “re-up” (commit to successor funds). This provides continuity and reduces fundraising friction.

LPs cannot commit new capital to Fund IV when Fund II and Fund III have returned minimal distributions. They lack the liquidity to make additional commitments while maintaining allocation discipline.

This forces LPs to either skip the re-up (losing access to preferred manager) or use secondary sales to manufacture liquidity from existing positions.

The private equity secondary market solves this coordination problem.

GP-Led Continuation Funds: The New Standard

Continuation vehicles represented the fastest-growing segment of the private equity secondary market in 2025.

How Continuation Funds Work

General partner holds a trophy asset that is not ready for exit but approaching fund term expiration. Traditional options are force a suboptimal sale or extend fund life (requiring LP approval).

Continuation fund provides third option. GP forms new dedicated vehicle. Trophy asset transfers at market valuation. Existing LPs choose: take liquidity now or roll equity into new vehicle.

New institutional investors provide fresh capital alongside rolling LPs. This extends hold period by 3-5 years while providing partial liquidity to exiting LPs.

Why This Became Normalized

Alignment improvement. Separates LPs who want liquidity from LPs who want continued exposure. Both get preferred outcome.

Valuation reset. Independent valuation process provides price discovery without forced sale.

Extended value creation. High-quality assets receive additional time to scale without market timing pressure.

GP fee stream. New management fees and carry opportunity for GP on extended hold period.

The structure benefits all parties when executed properly. This is why continuation funds transitioned from controversial to standard practice.

The Institutional Buyer Surge

The private equity secondary market attracted significant institutional capital in 2024-2025.

Dedicated secondary funds raised record commitments. Sovereign wealth funds built internal secondary teams. Family offices allocated to secondaries for vintage diversification.

Why Institutions Are Buying

J-curve mitigation. Buying existing fund positions eliminates early-year negative cash flow. Immediate distributions possible.

Vintage diversification. Access to 2015-2020 vintages no longer available in primary market.

Valuation opportunity. Purchasing at discounts to NAV provides margin of safety and enhanced return potential.

Faster deployment. Single secondary purchase can deploy $50-500 million immediately versus building primary portfolio over years.

Manager access. Secondary purchases provide exposure to oversubscribed top-tier GPs with closed primary funds.

This buyer demand supports pricing and increases market liquidity.

What This Means for Portfolio Construction

The maturation of the private equity secondary market changes optimal LP portfolio strategy.

The Traditional Approach

Commit to new primary funds annually. Build diversified portfolio across vintages, strategies, and managers over 10-15 years.

Accept J-curve (negative cash flow early, positive later). Wait patiently for distributions. Re-up with preferred managers.

The Modern Approach

Maintain core primary program for manager relationships and access. Add dedicated secondary allocation (10-25% of total private equity).

Use secondaries to rebalance portfolio, access closed vintages, and manage liquidity needs without disrupting primary commitments.

This “barbell strategy” combines primary fund access with secondary market flexibility.

The Risks That Remain

The private equity secondary market solves liquidity problems but introduces new risks.

Valuation Uncertainty

NAV figures provided by GPs reflect estimates, not market transactions. Buyers purchasing at 90% of NAV assume valuations are accurate.

If underlying portfolio companies are marked too high, the “discount” is illusory. Actual loss occurs when assets eventually exit below NAV.

Information Asymmetry

Sellers often know more about portfolio quality than buyers. Why is this LP exiting this specific fund position?

Adverse selection risk exists. Sophisticated LPs sell weakest positions while retaining strongest.

Market Timing Risk

Buying secondaries near market peaks means acquiring assets at elevated valuations even with NAV discounts.

Purchasing 2021 vintage positions in 2025 at 85% of NAV may still result in losses if those companies were marked at unsustainable valuations.

Concentration Risk

GP-led continuation funds often involve single-asset vehicles. Buying into concentrated positions increases idiosyncratic risk versus diversified fund portfolios.

These risks require sophisticated due diligence and valuation modeling.

The 2026 Outlook: Accelerating Growth

Multiple factors suggest the private equity secondary market will continue rapid expansion in 2026.

Demand Drivers

Distribution pressure intensifies. LPs entering fourth year without meaningful DPI will force secondary sales to rebalance portfolios.

Fundraising dependency. GPs unable to return capital cannot raise successor funds. Secondary transactions provide manufactured DPI.

Continuation fund normalization. More GPs view continuation vehicles as standard tool rather than emergency measure.

Dry powder deployment. Buyers have record capital committed to secondary strategies requiring deployment.

Supply Drivers

Vintage 2020-2021 maturity. Funds approaching term with unrealized portfolios will seek secondary solutions.

Down-round avoidance. Companies preferring continuation funds over IPOs at reset valuations.

LP rebalancing. Overallocated institutions selling positions to return to target allocations.

Market structure supports continued growth toward $250-300 billion annual volume by 2027.

Strategic Implications for Different Participants

The mainstreaming of the private equity secondary market changes strategy for all ecosystem participants.

For Limited Partners

Build secondary capabilities. Either allocate to dedicated secondary funds or develop internal expertise for direct secondary purchases.

Negotiate transfer rights. Ensure limited partnership agreements permit secondary transfers without onerous GP consent requirements.

Use secondaries proactively. Sell positions strategically for portfolio rebalancing, not just emergency liquidity.

Evaluate continuation funds critically. Analyze whether rolling into continuation vehicle provides better return than taking liquidity and redeploying.

For General Partners

Embrace continuation funds. View as legitimate portfolio management tool for high-quality assets not ready for traditional exit.

Facilitate LP transfers. Streamline consent processes for secondary sales to maintain LP relationships.

Provide transparency. Detailed portfolio data and conservative NAV marks support better secondary pricing.

Build secondary relationships. Cultivate buyer relationships for potential continuation fund partnerships.

For Family Offices

Allocate to secondaries. Shorter duration profile versus primary funds provides better liquidity matching.

Target GP-led deals. Continuation funds offer concentrated exposure to proven assets with clear value creation plans.

Leverage valuation expertise. Use direct investment experience to evaluate secondary opportunities others may undervalue.

Avoid overallocation. Secondary purchases can deploy capital faster than planned, creating new allocation management challenges.

The Structural Shift Is Complete

The private equity secondary market transformation from distress mechanism to core infrastructure is structural, not cyclical.

Eight consecutive quarters of distribution drought forced this evolution. Traditional exit pathways failed to return capital at scale. LPs demanded solutions.

The market responded. Secondary volume hit $210 billion in 2025. Pricing became transparent. Institutional buyers entered. GP-led continuation funds normalized.

This is the new reality of private equity portfolio management. The secondary market is now the third exit alongside IPO and M&A.

Limited partners who embrace this structural change will manage liquidity more effectively. Those who cling to “buy and hold until IPO” will face allocation constraints and fundraising friction.

General partners who view secondaries as portfolio management tools will provide better LP service and maintain fundraising momentum. Those who resist will lose LPs to more flexible managers.

The market has already separated into these categories. The only question is which one you are in.

#PrivateEquity #SecondaryMarket #LPLiquidity #ContinuationFunds #InstitutionalInvesting #PortfolioManagement

Trending

Backed By Leading Investment Groups and Family Offices