News and Announcements

Article highlight

The $3.5 Trillion Succession Wave: Why 48% of Australian Business Owners Are About to Destroy Value

Published 27.01.26

Australia’s Largest Wealth Transfer Has No Exit Plan Australian business succession planning is broken. An estimated $3.5 trillion in assets will pass from Baby Boomers to younger generations over the next two decades. The numbers reveal a crisis. 48% of Baby Boomer business owners plan to exit within five years. Only 24% have formal succession […]

Capital Insights

1

1

The Great Life Science Reset: Why the “Sick Care” Model is Failing

Read more

2

2

Australia’s A$4 Trillion Generational Pivot

Read more

3

3

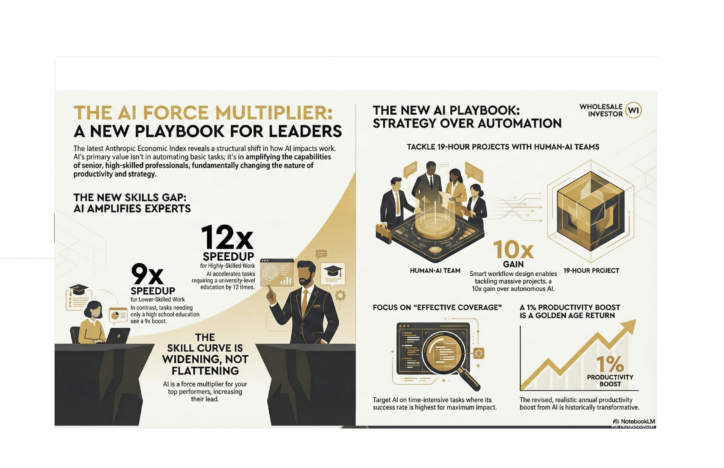

Anthropic Economic Index: Why the “Skills Gap” is About to Explode

Read more

4

4

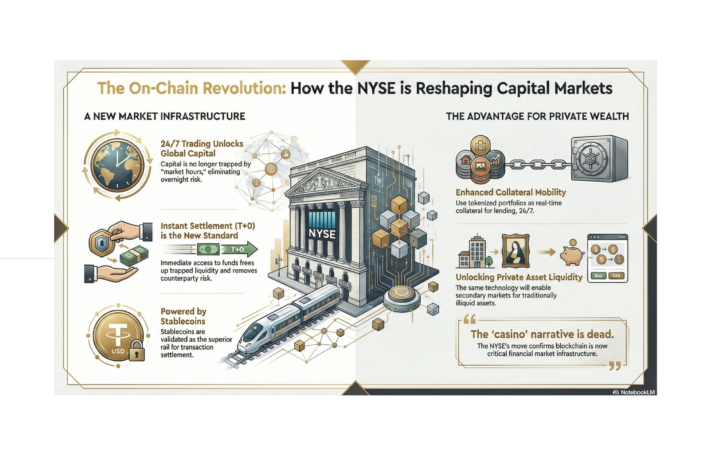

The Bridge Is Built: Why the NYSE’s Move Changes Capital Allocation Forever

Read more

Executive Interviews

Capital Insights

Company Updates

Venture Investor Interviews

Backed By Leading Investment Groups and Family Offices