News and Announcements

Inside the Australian Life Sciences Boom: Renowned Investors, World-Class Partners, World-Leading Breakthroughs

- Published January 29, 2026 11:44PM UTC

- Publisher Steve Torso

- Categories Capital Insights, Company Updates, Events, Landing, Trending

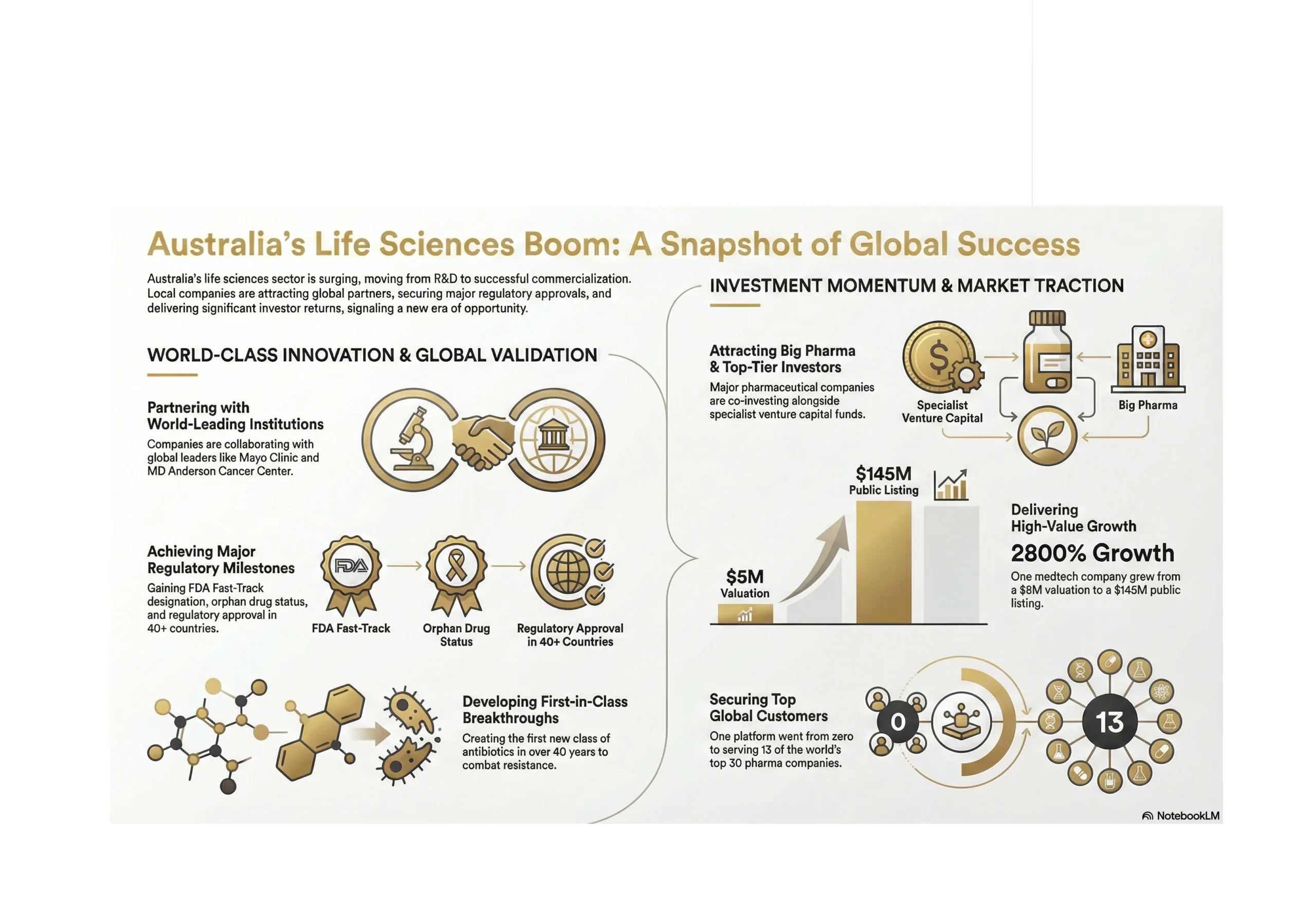

Mayo Clinic partnerships. FDA fast-track designations. World-leading cancer centres already running trials. The world’s largest pharmaceutical companies are co-investing. Here’s what stood out from the Emergence Preview Series.

For the past 4 months, I’ve been speaking with 70 to 80 life science and medical device founders across Australia. It’s been one of the most inspiring experiences I’ve had in my career.

When you have these conversations, you realise the absolute talent within our country. You realise the innovation potential coming down the pipeline. And you realise the global nature of this space, partnering with world-leading institutions, attracting backing from renowned investors, and building solutions that will change healthcare globally.

The Emergence Preview Series gave investors an early look at the companies presenting at Life Sciences Investor Day on February 18th. Here are the highlights that stood out and why this moment in Australian life sciences feels different.

Mayo Clinic-Backed Infection Prevention

Lindo Life Science is developing a first-in-class antimicrobial endotracheal tube designed to reduce ventilator-associated pneumonia, one of the most common and deadly infections in intensive care units worldwide. What sets them apart: they’re developing this technology in collaboration with Mayo Clinic and have secured $2 million in Australian Government Industry Growth Program funding to accelerate development.

VAP increases mortality, prolongs ICU stays, and adds tens of thousands of dollars per patient in avoidable costs. Lindo’s approach delivers continuous antimicrobial action directly where biofilm forms (without drugs or chemicals), and integrates into existing ICU workflows.

World-Leading Cancer Centres Already in Trial

Ferronova is tackling one of oncology’s most persistent problems: cancer recurrence after surgery. Their surgical guidance technology has been tested in 90 clinical trial patients including those who’ve had chemotherapy before surgery, a group where no other technology has been effective.

Trials are underway or planned at over 10 world-leading hospitals, including Peter MacCallum Cancer Centre in Australia and MD Anderson Cancer Center in the United States. Existing investors have already contributed $6 million to their Series A extension round, with a Series B planned for later this year.

FDA Fast-Track and Orphan Designation in Cell Therapy

Chimeric Therapeutics (ASX: CHM) is a clinical-stage cell therapy company with three assets in clinical development across trials in the US. Their lead asset, targeting colon cancer, neuroendocrine tumours, and certain pancreatic cancers, is just a few patients away from completing Phase 1 with FDA approval to move into Phase 2 already secured.

They’ve also been granted FDA fast-track approval and orphan drug designation, positioning them for an accelerated path to market in indications with significant unmet need.

From $5 Million to $145 Million ASX Listing

Bioshore Ventures shared a case study illustrating value creation in Australian medtech. Their team backed Tetratherix, a novel thermogel technology for a range of clinical indications, at a $5 million valuation in 2020. Last year, they floated the business on the ASX at $145 million.

General Partner Jeff Reid noted that aggregated returns for medical devices sit around 74% compared to 15% for pharmaceuticals, largely because device companies can iterate during clinical development, whereas drug companies are locked into a specific molecule once trials begin.

Pharma Giant Co-Investment in Neurodegeneration

KP Rx, a healthcare-focused venture capital fund, revealed they invested alongside one of the world’s largest pharmaceutical companies in Skin2Neuron, a preclinical cell therapy targeting Alzheimer’s and Parkinson’s disease.

The technology harvests stem cells from hair follicles that, when injected into a specific part of the brain, differentiate into neurons and migrate to damaged areas. Manufacturing complexity is low, rejection risk is minimal, and the strategic co-investor has no first right of refusal, positioning the company for a competitive exit process after Phase 1 data.

Zero to 13 of the Top 30 Pharma Companies

Inventia Life Science, another KPRX portfolio company, has developed a 3D bioprinting platform that produces high-throughput organoids for preclinical drug discovery, the only technology globally that can produce organoids at scale with low variability.

Since KPRX’s investment, Inventure has gone from zero pharmaceutical clients to 13 of the top 30 pharma companies worldwide. They’re also running precision medicine pilots in children’s brain cancer at a Sydney site and pancreatic cancer in Melbourne, testing drug combinations on patient-derived microtumours to identify optimal treatments before administering them.

40+ Country Regulatory Approval with Revenue Traction

Eyerising International has developed the world’s first patented home-use light therapy for myopia, the only technology that can reverse myopia and the only therapy effective for high myopia.

The validation stack is impressive: 30+ peer-reviewed publications in top journals, regulatory approval in 40+ countries, an established global supply chain, $2 million in revenue run-rate, and 2,000 active patients on a recurring subscription model. They’re targeting an addressable market of 8 million high-myopia children with $3 billion in recurring revenue potential and raising a $5 million Series A to expand into adult indications, a market five times larger.

First New Class of Antibiotics in 40+ Years

Recce Pharmaceuticals (ASX: RCE) has developed what they describe as the first new class of antibiotics in over four decades designed to work and keep working with repeated use. This addresses the fundamental challenge of antibiotic resistance, which the WHO has identified as one of the top global health threats.

Their Phase 3 candidate for diabetic foot ulcer infections represents a near-term commercial opportunity, with multiple clinical data points and potential late-stage approval expected later this year.

FDA Cleared with the Broadest Global Indication

Navi Medical Technologies has developed the NeoAV ECG tip location system — FDA cleared with the broadest indication for use of any ECG tip location system in the world. Products are already deployed in leading US sites, and the company is closing out a funding round with plans to scale their team and sales this year.

RMIT-Developed, US Innovation Award Winner

Snoretox has developed a world-first drug that strengthens specific weak muscles by direct injection, lasting four to six months. Developed at RMIT University Melbourne, the technology won the top innovation award in the US veterinary market in 2025.

Applications span pelvic floor weakness, sleep apnoea, facial droop after stroke, incontinence, motor neurone disease, and muscle recovery after injuries. They’re now raising Series A to commence human clinical trials and enter the veterinary market.

Sovereign Pharmaceutical Manufacturing

Elemental IV is building sovereign pharmaceutical-grade sterile fluid manufacturing capability in Australia starting with IV saline and water for injection, the base ingredients used every day in hospitals.

They’re designing a modular GMP facility that supports both large-scale sterile fluid manufacturing and clinical compounding, giving hospitals flexibility and security of supply. They’re seeing strong traction with state public health and defence, supported by experienced aseptic and GMP manufacturing leaders as potential investors and advisers.

Translating the “Farm Effect” into Asthma Therapy

Respiradigm is built around decades of research showing that children raised on traditional farms are much less likely to develop asthma. They’re translating this insight into a therapeutic approach for adult asthma designed to reduce episodes and severity.

Founder Dr Anya Jones will be presenting on the main stage at Emergence 2026.

Why This Moment Feels Different

I’ve been doing this work for years, but I’ve never been more inspired than I am right now.

The companies you’ve just read about aren’t pitching ideas, but they’re presenting partnerships with Mayo Clinic and MD Anderson, co-investments from the world’s largest pharmaceutical companies, FDA clearances, clinical trial data from world-leading institutions, and teams who have built and exited in the sector before.

Australia generates more intellectual property in medical technology per capita than any country on earth. What’s been missing is the capital and support to commercialise it. That’s changing. Specialist funds like Bioshore Ventures, KPRX, and the Tegmen Fund are backing these companies with patient capital and deep operational expertise. Government programs are providing non-dilutive funding. And global institutions are taking notice.

This is one of the greatest times in history to be building a life sciences company in Australia. And for investors, it’s one of the greatest times to be deploying capital into the sector.

Life Sciences Investor Day is sold out. But if you’re registered for Emergence 2026, this is the deal flow you’ll be engaging with directly at the Four Seasons Sydney on February 18th.

Steve Torso is the Founder and CEO of Wholesale Investor and CapitalHQ.

Trending

Backed By Leading Investment Groups and Family Offices