News and Announcements

Frost and Sullivan Briefing on “10 Emerging Industries” Confirms that Qimono is in the Sweet Spot

- Published December 09, 2014 3:01PM UTC

- Publisher Wholesale Investor

- Categories Company Updates

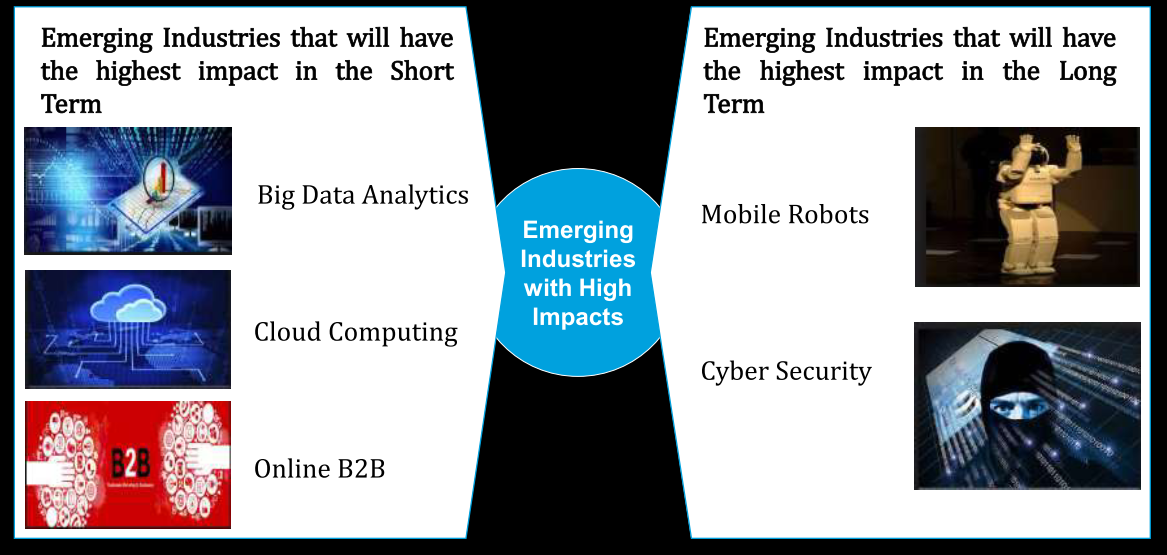

A briefing released by Frost and Sullivan has identified that the emerging industries with the highest impacts in the short term are big Data analytics, Cloud computing and Online B2B. This is confirmed by evidence from the venture funding community who are already seeing superior returns.

Qimono provides a cloud platform for both business advisors and those seeking business advice. Business Advisories, Consultancies, Associations, Chambers and Business development agencies all use Qimono to increase their value to their business communities. They are also finding that they can increase their reach into the small business sector and harvest “data” at a fraction of traditional cost. Essentially Qimono is a Cloud platform for Business Advisory in much the same way as Xero is a platform for accountancy.

“We are a B2B, Cloud play that enables big data” says Keith Phillips CEO of Qimono. “We have focused on a Small Business as cloud technology can uniquely provide reach and reduce cost of servicing small business to the extent that consultancy and advice becomes viable.”

Frost & Sullivan pioneered the identification, analysis, and monitoring of new emerging technologies and markets. Frost & Sullivan was always at the forefront – just as new markets and technologies appeared – with up-to-date research on potential markets. Frost & Sullivan employs 1,800 analysts, growth consultants, and visionaries in 40 global markets.

The recent study evaluated some 15 industries on the basis of market attractiveness, level of certainty, degree of disruption, degree of Innovation and came up with this roadmap.

Source: Frost and Sullivan “Burst that Bubble : 10 Emerging Industries”

Evidence from the investor community supports this view. In an in article Reuters PE Hub Cindy Padnos founder and managing partner of Silicon Valley company Illuminate Ventures is quoted : “The facts are clear: B2B investment outcomes exceed B2C in both IPOs and M&A transactions. Perhaps more important than any of the other factors influencing the higher M&A revenue multiples and better post IPO performance is the fact that the subscription SaaS business models create more stable companies: they have a more predictable recurring revenue stream. This makes them an attractive asset to own.” Cindy Padros then goes on to say that “It’s a perfect storm for the B2B opportunity…exit options are increasing and the market size is roughly 20% larger than B2C and growing rapidly. There is more opportunity for both larger and more rapid outcomes. For example, SlideShare raised just $3M dollars before it sold to LinkedIn for $119M and DemandForce was acquired by Intuit for $424M after raising less than $12M – both within 3 years of their initial financings.” Source: Reuters PE Hub

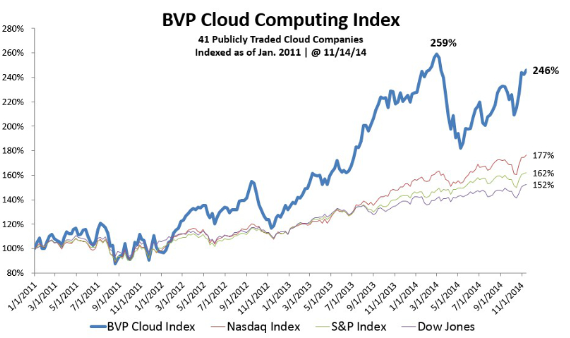

Bessemer Venture Partners has been tracking the performance of the sector against Nasdaq, S&P and Dow Jones as they focus on the sector. They comment on their corporate site: “We believe Cloud Computing is the most important trend in the software industry of the decade. Bessemer has been an advocate of Cloud Computing for more than a decade, investing in early pioneers in this high-growth market segment.”

Source: Bessemer Venture Partners as of 14th Nov 2014

BVP has offices in New York, Silicon Valley, Boston, Bangalore and Herzliya and manages more than $4 billion of venture capital invested in over 130 companies around the world. BVP focuses investment activity around several well-developed thematic “roadmaps.

Keith Phillips concluded: “What makes Qimono exceptional from an investor prospective is that we are a B2B service sitting in the vortex of a technology and market shift. We have already seen a shift occurring in our nearest market neighbour “Accountancy”. It is our belief that cloud advisory will be the next big thing.”

Contact: [email protected]

Company Updates

Backed By Leading Investment Groups and Family Offices