News and Announcements

Australia’s A$4 Trillion Generational Pivot

- Published January 20, 2026 5:00PM UTC

- Publisher Bella Battsengel

- Categories Capital Insights, Trending

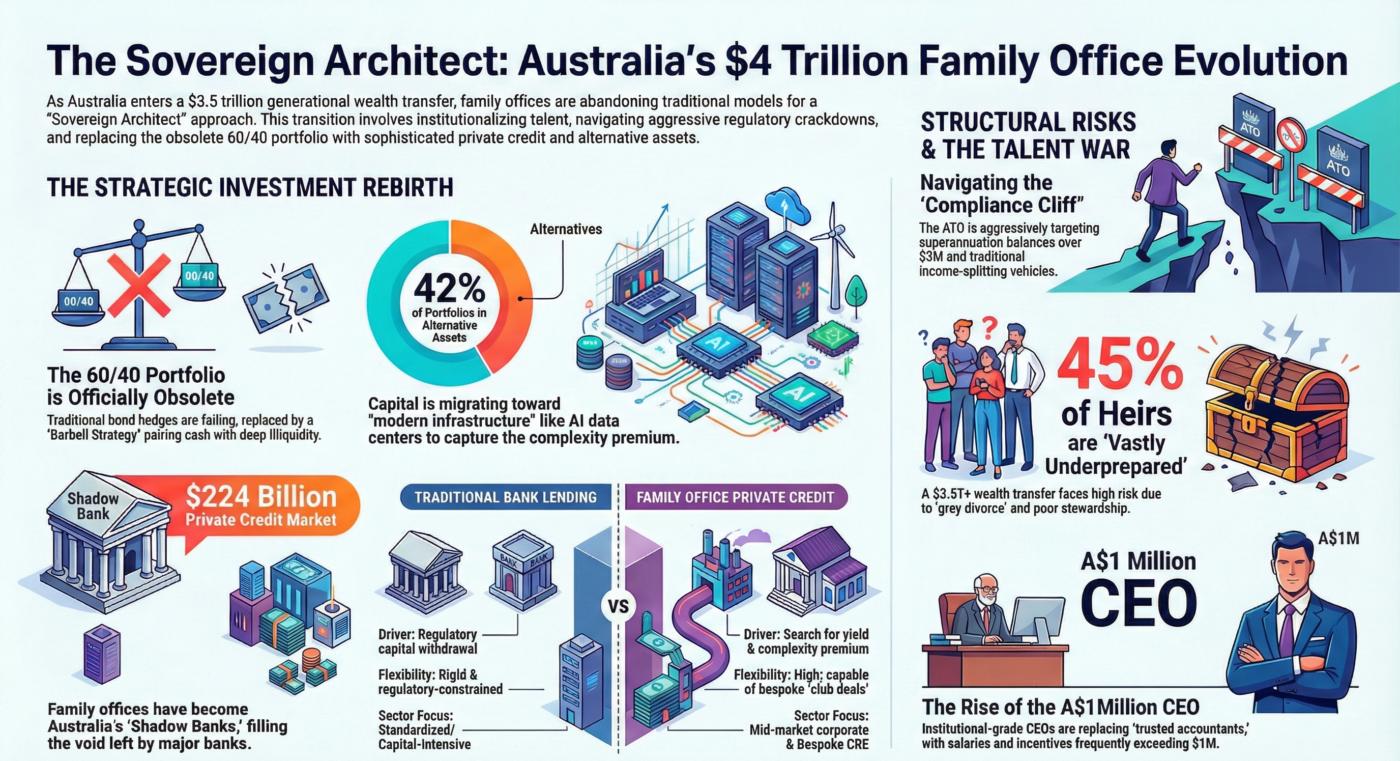

Australia’s wealth management landscape is undergoing a dramatic transformation. For decades, family offices operated quietly during the “Great Moderation”, an era characterised by low volatility, cheap capital, and global economic synchronisation. Today, that stability has given way to fiscal uncertainty, geopolitical tensions, and intensifying regulatory scrutiny.

Yet amid this global turbulence, Australia has emerged as a remarkably stable destination for wealth, now holding a record A$4 trillion in high-net-worth assets. This surge isn’t just about growth, it’s forcing a fundamental evolution in how Australian families manage and protect their wealth.

The old “family business” model is being replaced by sophisticated “family enterprises” led by what we call the Sovereign Architect. These aren’t simply investors, they’re strategists who design resilient, self-sustaining ecosystems built to weather a decade of institutional-grade challenges.

1. Why the Traditional 60/40 Portfolio No Longer Works

The End of Balanced Investing as We Know It

The 60/40 portfolio—60% equities, 40% bonds—has been the foundation of balanced wealth management for generations. Sophisticated investors have now comprehensively abandoned this approach.

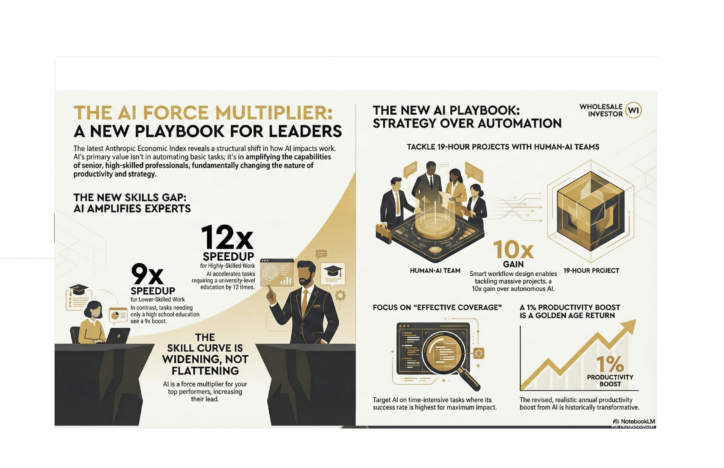

The replacement? A barbell strategy that pairs high liquidity (cash and short-dated bonds) with deep, conviction-led illiquid investments. Alternative assets now comprise 42% of global family office portfolios, with Australian family offices pushing this even further as they pursue the “complexity premium.”

Understanding the Correlation Breakdown

The technical reason is critical: bonds no longer hedge against equity downturns. In today’s inflationary environment, equities and bonds increasingly move together. When inflation rises, both asset classes can fall simultaneously, destroying the traditional diversification benefit.

This correlation breakdown makes reliance on public markets dangerously risky. Instead, capital is flowing towards modern infrastructure assets, think the A$24 billion AirTrunk acquisition, which represents the physical backbone of Australia’s AI revolution and digital economy.

Key insight: Asset allocation has decoupled from public market beta. The traditional 60/40 portfolio has been comprehensively abandoned in favour of strategies that combine immediate liquidity with long-term, illiquid opportunities.

2. How Australian Family Offices Became Shadow Banks

Filling the Void Left by Traditional Lenders

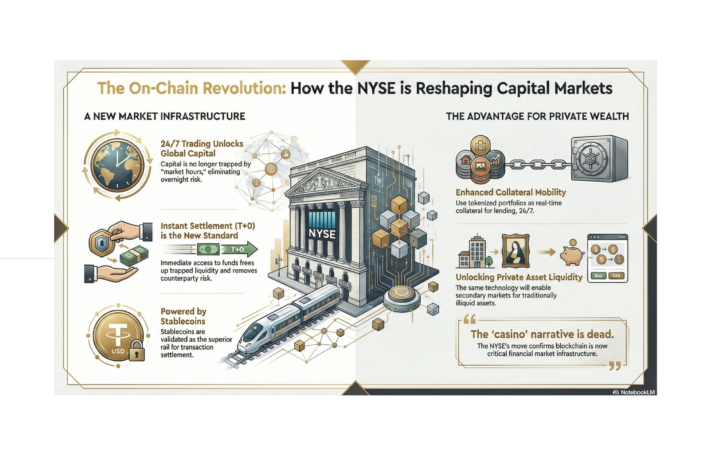

Australia’s Big Four banks are retreating under the weight of Basel III capital requirements and APRA’s stringent regulations. Family offices have stepped into this structural gap, fuelling a private credit market that has surged to A$224 billion.

By providing capital for mid-market corporate lending and commercial property development, family offices have effectively become a parallel banking system for the Australian economy.

The Risks: Shadow Defaults and Credit Cycles

Whilst yields of 500-700 basis points over the risk-free rate are attractive, the credit cycle is turning. We’re witnessing a growing divide between performing and distressed credit.

Rising corporate insolvencies have introduced the risk of “shadow defaults”, where lenders engage in “amend, extend, and pretend” practices to mask non-performing loans. Navigating these waters successfully requires deep workout capabilities and credit expertise.

Comparison: Traditional Bank Lending vs Family Office Private Credit

- Traditional banks: Constrained by APRA/Basel III regulations, focused on capital-intensive standardised lending with limited flexibility

- Family offices: Driven by yield-seeking and complexity premiums, focused on mid-market corporate and bespoke commercial property, offering high flexibility through club deals

3. The Compliance Cliff: Navigating Australia’s New Tax Reality

The End of Simple Tax Structuring

The era of “set-and-forget” tax planning has ended. The ATO has launched a multi-front regulatory campaign against traditional wealth vehicles. Australian family offices face three critical challenges:

Division 296: The Superannuation Tax on Unrealised Gains

This watershed legislation targets superannuation balances exceeding A$3 million. Most controversially, it taxes unrealised gains, creating a liquidity trap where a valuation spike in an illiquid asset triggers a massive tax bill without generating any cash to pay it.

The Bendel Case: Unpaid Present Entitlements Under Scrutiny

This high-stakes High Court battle concerns Unpaid Present Entitlements (UPEs). If the ATO loses its appeal, families could continue retaining working capital within corporate beneficiaries at the 25-30% corporate rate without triggering Division 7A loan rules, a significant liquidity advantage.

Section 100A: Crackdown on Income Splitting

New enforcement requires beneficiaries to receive the actual economic benefit of distributions, not just paper allocations.

The Accelerated Wealth Transfer

This “compliance cliff” is forcing families to transfer wealth earlier than planned. To remain tax-efficient under Section 100A, families are increasingly “giving while living”, transferring liquidity to the next generation to secure tax deductions and maintain compliance.

4. The Million-Dollar Professional: Death of the Trusted Accountant Model

The War for Talent in Family Offices

As family offices institutionalise, they’re competing for the same talent as major pension funds and private equity firms. The traditional “trusted accountant” or “family confidant” is being replaced by institutional-grade CEOs and Chief Investment Officers.

Managing portfolios exceeding $100 million demands sophisticated expertise, and significant compensation to match.

What Australian Family Office Professionals Earn

Base salaries for family office CEOs in Australia now range between A$500,000 and A$625,000. Total packages, including incentives, frequently exceed A$1 million.

Mirroring private equity structures, these professionals increasingly demand “shadow equity” or carried interest in direct deals. 73% of professionals now receive discretionary bonuses, with nearly half being formulaic rather than purely discretionary, ensuring non-family executives are incentivised to grow real portfolio value.

5. The A$3.5 Trillion Generational Transfer and Its Preparedness Paradox

Australia’s Looming Wealth Transfer Crisis

Australia stands on the precipice of a generational wealth transfer estimated between A$3.5 trillion and A$4.9 trillion. However, the scale of this movement is matched by a staggering lack of preparation: 45% of heirs are considered vastly underprepared for wealth stewardship.

Human Risk: The Greatest Threat to Wealth Preservation

In 2026, the risk of wealth destruction comes not from markets, but from within families themselves. The rise of “grey divorce” amongst Baby Boomers and the complexity of blended families make soft governance structures, like family constitutions, more vital than any investment committee.

Educational Solutions: Shadow Boards and Satellite Portfolios

Forward-thinking Sovereign Architects are implementing structured educational approaches:

Shadow Boards: Allow next-generation members to observe high-level decision-making processes without voting authority, building governance skills progressively.

Satellite Portfolios: Provide heirs with smaller capital pools (typically A$500,000) to manage independently, allowing them to learn risk and return principles in a controlled environment with real consequences.

6. From Excel Spreadsheets to Concierge Cybersecurity

The End of the Excel Era

Manual portfolio management persists in 40% of family offices, an operational risk that’s no longer tenable. The complexity of tracking private market holdings, property registries, and multiple bank relationships through spreadsheets creates dangerous gaps and errors.

Modern family offices are migrating towards integrated digital platforms and “whole of wealth” dashboards that provide real-time aggregation across all asset classes and institutions.

The Cybersecurity Vulnerability

This digitalisation creates a new target. Family offices represent “low-hanging fruit” for cybercriminals, possessing bank-level wealth with small-business-level security. Globally, 43% of family offices have already faced cyberattacks.

The response is a shift towards “Essential Eight” security protocols and “concierge cybersecurity”, comprehensive protection that extends beyond office systems to the personal networks and home devices of family members as part of a holistic lifestyle security package.

The Rise of the Sovereign Architect: Building Wealth for a Fragmented World

The Australian family office has evolved from a passive wealth repository into a professionalised, influential pillar of the national financial system. This is the era of the Sovereign Architect, principals who recognise that in a world of geopolitical fragmentation and aggressive regulation, resilience must be deliberately engineered.

The Fundamental Question for 2026

As you evaluate your own wealth structures, ask yourself: Is your wealth architecture built for the “Great Moderation” of the past, or is it designed for the fragmented world order of the future?

Trending

Backed By Leading Investment Groups and Family Offices