News and Announcements

Australian Startups: Key Advice for Explosive Growth in 2025

- Published May 22, 2025 12:00PM UTC

- Publisher Bella Battsengel

- Categories Trending

The Australian startup scene continues its dynamic evolution, with early-stage funding demonstrating encouraging resilience. However, the journey from promising newcomer to established success hinges on a well-defined strategy, particularly when it comes to securing crucial later-stage investment. The Australian Financial Review’s “Fast Starters” list serves as a beacon, highlighting the remarkable growth trajectories of young Australian companies and offering invaluable lessons for those on a similar path.

Understanding the Australian Startup Landscape in 2025

While the appetite for early-stage ventures remains robust, securing significant Series A and beyond funding in Australia demands a meticulously crafted business plan, robust traction, and a compelling vision for scale. The sectors attracting the most attention and investment continue to be at the forefront of global innovation, with Fintech, Climate Tech, and Biotech leading the charge. Notably, 2024 witnessed a rise in median deal sizes for early-stage funding, signalling increased confidence in nascent Australian innovation. A significant portion of these deals involved international investors (57% in 2024), underscoring the global appeal of Australian ingenuity.

Smart Funding Strategies for Sustainable Growth

Navigating the funding landscape requires a strategic and multifaceted approach. Australian startups should actively explore a range of avenues:

- Venture Capital (VC): Understand the different stages of VC funding prevalent in Australia (Seed, Series A, B, etc.) and the typical investment ranges associated with each. Building relationships with local VC firms specialising in your sector is paramount. Research prominent Australian VCs like Square Peg Capital, AirTree Ventures, and Blackbird Ventures, and tailor your pitch to their investment thesis.

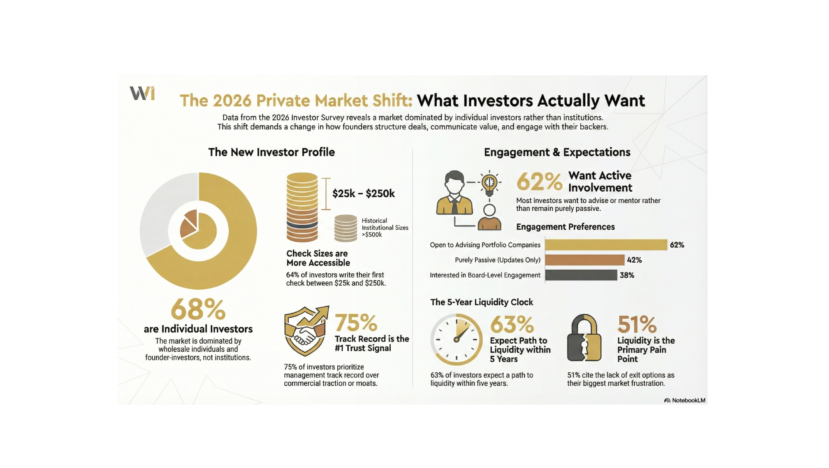

- Angel Investors: Engage with angel investor networks and syndicates active in Australia. These early-stage backers often provide not just capital but also invaluable mentorship and industry connections. Platforms like Angel Investors Australia can be a starting point.

- Government Grants & Incentives: Leverage the various government programs designed to support innovation and growth, such as AusIndustry grants and the Research and Development (R&D) Tax Incentive. Thoroughly research eligibility criteria and craft compelling applications.

- Alternative Funding: Explore options like crowdfunding platforms (e.g., Birchal, Equitise) to engage your community and raise capital, or consider debt financing options tailored for startups as your business matures.

Building a High-Performing and Aligned Team

Attracting and retaining top talent is the lifeblood of any successful startup. In today’s competitive market, salary alone is insufficient. Cultivating a positive company culture grounded in a clear and inspiring purpose is essential. Consider these strategies:

- Culture First: Foster a culture of transparency, collaboration, and continuous learning. Implement regular feedback mechanisms, offer flexible work arrangements where feasible, and prioritise team-building activities that reinforce your company values.

- Purpose-Driven Mission: Articulate a compelling company purpose that resonates with potential employees who seek more than just a pay check. Highlight the impact your startup aims to make.

- Employee Share Schemes (ESS): Implement well-structured ESS to incentivise employees, align their interests with the company’s long-term success, and foster a sense of ownership. Seek legal and financial advice to ensure compliance with Australian regulations. Many successful Australian startups have leveraged ESS to attract and retain key talent.

- Diverse and Proactive Hiring: Focus on recruiting individuals with a diverse range of skills, experiences, and perspectives. Prioritise proactive problem-solvers who demonstrate a strong alignment with your company’s core values.

Effective Marketing in a Dynamic Digital Landscape (2025)

Marketing in 2025 requires agility and a deep understanding of evolving consumer behaviour and digital trends. Authenticity remains paramount; build trust through honest and transparent communication. Key strategies include:

- Clear Objectives: Define specific, measurable, achievable, relevant, and time-bound (SMART) marketing objectives that directly support your overall business goals.

- Targeted Audience Understanding: Invest in understanding your ideal customer profile in the Australian context. What are their pain points, online behaviours, and preferred communication channels?

- Unique Selling Proposition (USP): Clearly articulate what makes your startup stand out from the competition. What unique value do you offer the Australian market?

- Dominant Digital Presence: A robust digital strategy is non-negotiable. This includes:

- Search Engine Optimisation (SEO): Optimise your website and content to rank highly for relevant Australian search terms.

- Social Media Marketing: Identify the platforms most popular with your target audience in Australia (e.g., Instagram, LinkedIn, TikTok) and create engaging, locally relevant content.

- Content Marketing: Develop valuable and informative content (blog posts, articles, videos) that addresses your audience’s needs and establishes your expertise.

- Influencer Marketing: Collaborate with relevant Australian influencers to reach specific target demographics and build brand credibility.

- Data Analytics: Continuously track and analyse your marketing performance to optimise campaigns and improve ROI.

Strategies for Sustainable Scaling

Scaling up effectively means achieving significant growth without a disproportionate increase in costs. Lay the groundwork for scalable operations by:

- Validate Your Business Model: Ensure you have achieved product-market fit and have a repeatable and profitable business model before aggressively scaling.

- Leverage Technology and Automation: Implement technology solutions and automation tools (e.g., CRM, marketing automation, cloud-based platforms) to streamline processes, improve efficiency, and reduce manual workload.

- Strategic Outsourcing: Consider outsourcing non-core activities (e.g., payroll, accounting, customer support) to free up internal resources and focus on your core competencies.

- Build an Adaptable Team: Cultivate a team with the skills and mindset to navigate rapid growth and change. Invest in training and development to ensure your employees can adapt to evolving roles and responsibilities.

The Innovation Edge: Staying Ahead in 2025

Innovation remains the engine of startup growth. Key trends shaping the Australian landscape include:

- Artificial Intelligence (AI): Explore opportunities to integrate AI into your products, services, or operations to enhance efficiency, personalise customer experiences, and gain a competitive edge. Several Australian startups are already making significant strides in AI across various sectors.

- Sustainability and Climate Tech: With increasing global focus on sustainability, startups in clean energy, sustainable agriculture, waste management, and carbon capture are attracting significant attention and investment in Australia.

- Biotech and Healthtech: Australia boasts a strong research and development sector in life sciences. Biotech and healthtech startups focused on innovative therapeutics, diagnostics, and digital health solutions continue to be highly sought after by investors.

Lessons from Australia’s Fast Growers

The AFR’s “Fast Starters” list provides a tangible roadmap for aspiring high-growth startups. Eligibility for the list in 2025 (based on the previous financial year) typically requires:

Eligibility for AFR Fast Starters List

| Criteria | Requirement |

| Operating Period | Less than four years |

| Minimum Turnover | At least AUD 500,000 |

| Revenue Growth | Higher than previous year |

| Maximum Employees | Fewer than 200 |

| Customers | More than one main customer |

Analysing the companies that consistently feature on this list reveals common threads: a deep understanding of market needs, effective leveraging of technology for scalability, a strong focus on customer acquisition and retention, and the ability to adapt quickly to changing market dynamics. Many also demonstrate a commitment to innovation and building strong, purpose-driven teams.

Conclusion: Navigating the Path to Australian Startup Success

Achieving sustainable growth in the Australian startup ecosystem in 2025 demands a holistic approach. By strategically navigating funding opportunities, building a resilient and aligned team, implementing effective and data-driven marketing strategies, focusing on scalable operations, and embracing the power of innovation, Australian startups can position themselves for significant success. Learning from the journeys of Australia’s fastest-growing companies provides invaluable insights and inspiration for navigating the exciting and challenging path ahead. The opportunities are ripe for those who are prepared, adaptable, and relentlessly focused on delivering value to the market.

Trending

Backed By Leading Investment Groups and Family Offices