News and Announcements

What Active Private Market Investors Told Us They Want in 2026

- Published February 13, 2026 7:26AM UTC

- Publisher Steve Torso

- Categories Capital Insights, Landing, Trending

We just released the 2026 Investor Survey. It’s the most comprehensive look at what private market investors are actually thinking, planning, and prioritising as they deploy capital this year.

We surveyed active investors across 8 geographic regions. 25 questions. Everything from sector preferences and deal structures to trust markers, frustrations, and how they want to engage with the companies they back.

This is not an opinion. This is data. And some of it challenges the assumptions that founders, fund managers, and advisors have been operating on for years.

Here’s what stood out.

The Market Is Not What Most Founders Think It Is

There’s a persistent belief in the startup ecosystem that raising capital means chasing VCs and institutions. The data tells a very different story.

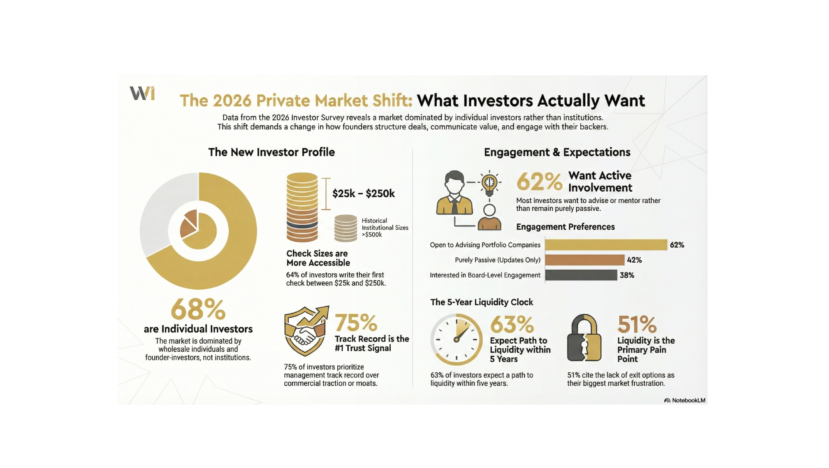

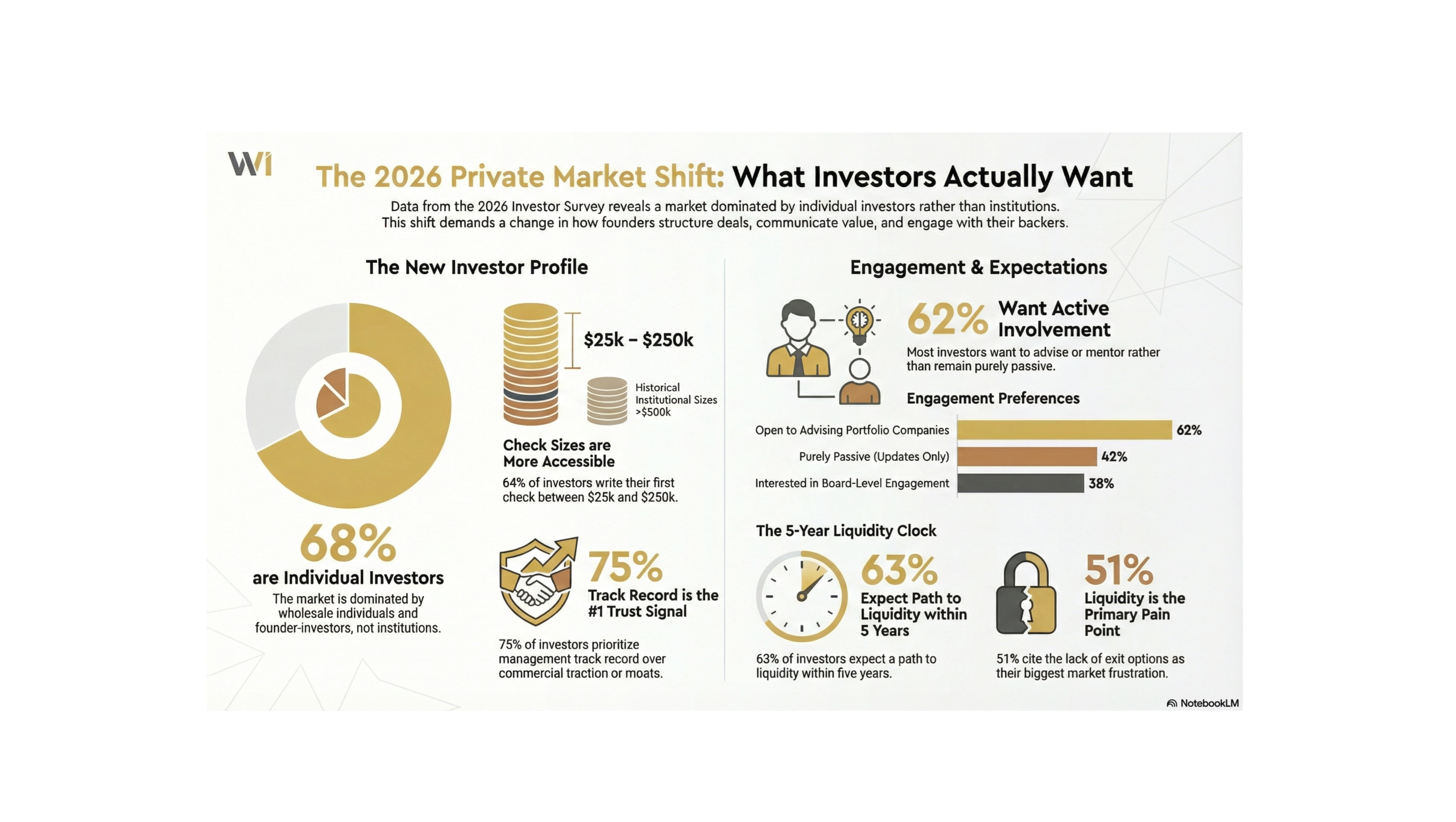

44% of respondents are Sophisticated or Wholesale Individual Investors. When you combine that with Founder-Investors at 24%, nearly 68% of the active investor base are individuals, not institutions.

This has massive implications for how you structure your raise, how you communicate, and who you’re actually pitching to. If your deck is built for a Sand Hill Road VC partner, you’re optimising for a minority of the market.

The data also show that 45% of investors hold 1 to 5 investments, and 17% are looking to make their first private-market investment. That’s significant untapped capacity sitting right in front of founders who know how to engage it.

Where Capital Is Flowing

Technology and Deep Tech lead sector deployment intentions for 2026. But the data reveals something more interesting than a simple ranking.

The appetite is genuinely diversified. HealthTech and Renewables both attract strong interest. Traditional Private Equity remains a priority. Private Credit continues to grow as investors look for yield with downside protection.

What’s particularly interesting is the gap between personal conviction and capital deployment. Investors told us where they feel deep personal conviction. They also told us where they plan to deploy capital. Those two lists don’t perfectly overlap, and that gap represents opportunity for founders who can bridge it.

The full breakdown of sector preferences, stage focus, and conviction areas is in the report.

Deal Mechanics Tell the Real Story

This is where the survey gets really practical for anyone raising capital.

We asked investors about the sizes of their first investment. 43% write their first check between $25K and $100K. Expanding to $250K captures 64% of the market.

That’s the reality of private markets. The entry point for most investors is far lower than many founders assume. This doesn’t mean you can’t raise large rounds. It means your round structure needs to accommodate how most investors actually deploy capital.

We also looked at follow-on behaviour, preferred deal structures, credit objectives, return targets, and liquidity expectations. Each of these tells a story about what investors need to see before they commit and what keeps them coming back for follow-on rounds.

One data point worth highlighting. 46% of investors expect liquidity within 3 to 5 years. When you add those looking for even shorter horizons, 63% want their money back within 5 years. That’s faster than most founders plan for, and it’s creating a tension that the smartest founders are already addressing.

Trust Is Not What You Think It Is

We asked investors which factors influence their decision to pursue an opportunity before they even schedule a meeting.

75% said management track record.

That number stood alone at the top. It wasn’t close.

Commercial traction and competitive moat followed, but the dominance of track record as a trust signal should change how every founder builds their pitch deck and investor communications.

We also asked what factors investors consider when evaluating fund managers. The trust markers shift in interesting ways. Track record still leads, but the second and third priorities look different from direct investments. The full comparison is in the report.

What ranked last in the direct investment trust markers is also worth noting. It challenges some of the prevailing narratives in the market right now.

The Frustration Gap

51% of investors said their biggest frustration with private markets is the lack of liquidity and exit options.

That’s the number one pain point. More than noise. More than due diligence burden. More than missed opportunities. More than founders who disappear after they’ve banked the investment.

The second biggest frustration is the signal-to-noise problem. 45% said there’s too much noise and not enough deal flow that matches their specific thesis.

These two frustrations together tell you exactly what investors are desperate for. A credible path to exits and a way to cut through the noise to find opportunities that actually match what they’re looking for.

Investors Want to Do More Than Write Checks

This was one of the most striking findings in the entire survey.

62% of investors said they’re open to advising portfolio companies. Not passive. Not just receiving monthly updates. Actively advising, mentoring, and contributing strategically.

Only 42% want to be purely passive investors receiving updates.

38% are interested in board-level engagement. And nearly a quarter are willing to lead rounds and bring other investors to the table.

This is a massive amount of untapped value. Most founders treat their investors as passive capital providers and never create structured ways for them to contribute. The data says investors want to do more. The founders who figure out how to activate that engagement will have a significant advantage.

How Investors Want to Hear From You

We asked about communication preferences. The answers are clear, and they should inform every founder’s investor relations strategy.

Email is the channel. That’s not a surprise. But the preferred frequency and the type of information investors want to receive are worth understanding in detail.

We also found that 66% of respondents engage in some form of advisory activity beyond just investing. They’re making introductions. They’re advising on strategy. They’re organising syndicates. This blended investor-advisor profile is more common than most people realise, and it changes how platforms and founders should engage this audience.

The Advisory and Partnership Opportunity

The final section of the survey looked at advisory engagement and interest in structured partnership programmes.

The numbers here are remarkable. 87% of respondents expressed interest or openness to structured partnership opportunities. Only 13% said no outright.

For anyone building advisory practices, managing capital, or connecting founders with investors, this data validates that there is an enormous appetite for better infrastructure around how capital gets deployed and how relationships get managed.

What This Means for 2026

The survey paints a clear picture. Private markets are dominated by individuals, not institutions. These investors are writing accessible first checks. They want to be engaged, not passive. They’re frustrated by noise, lack of liquidity, and poor communication. They trust teams above everything else. And they’re looking for better infrastructure to support their investment decisions.

Every data point in this survey has practical implications for how you raise capital, how you deploy it, and how you build relationships with the people on the other side of the table.

The full 2026 Investor Survey is available to download now.

I’ll be going deeper on these findings at Emergence 2026 and unpacking what they mean for how capital will move this year. If you haven’t registered yet, I’d encourage you to join us.

Steve Torso, Founder, Wholesale Investor and CapitalHQ

Trending

Backed By Leading Investment Groups and Family Offices