News and Announcements

The Private Capital Infrastructure Is Failing High-Growth Companies

- Published February 13, 2026 10:00AM UTC

- Publisher Bella Battsengel

- Categories Capital Insights, Capital Raising Tips, Trending

The Broken Reality of Capital Raising Infrastructure

Venture capital poured 55% of global funding into AI companies in 2025. Seed and Series A rounds saw 70% of capital flow to AI-related opportunities. The capital is available. The demand is clear.

But the infrastructure connecting founders to investors remains unchanged. Deal flow arrives through LinkedIn messages, cold emails, and advisor introductions. Investor updates are manual. Follow-ups disappear into silence.

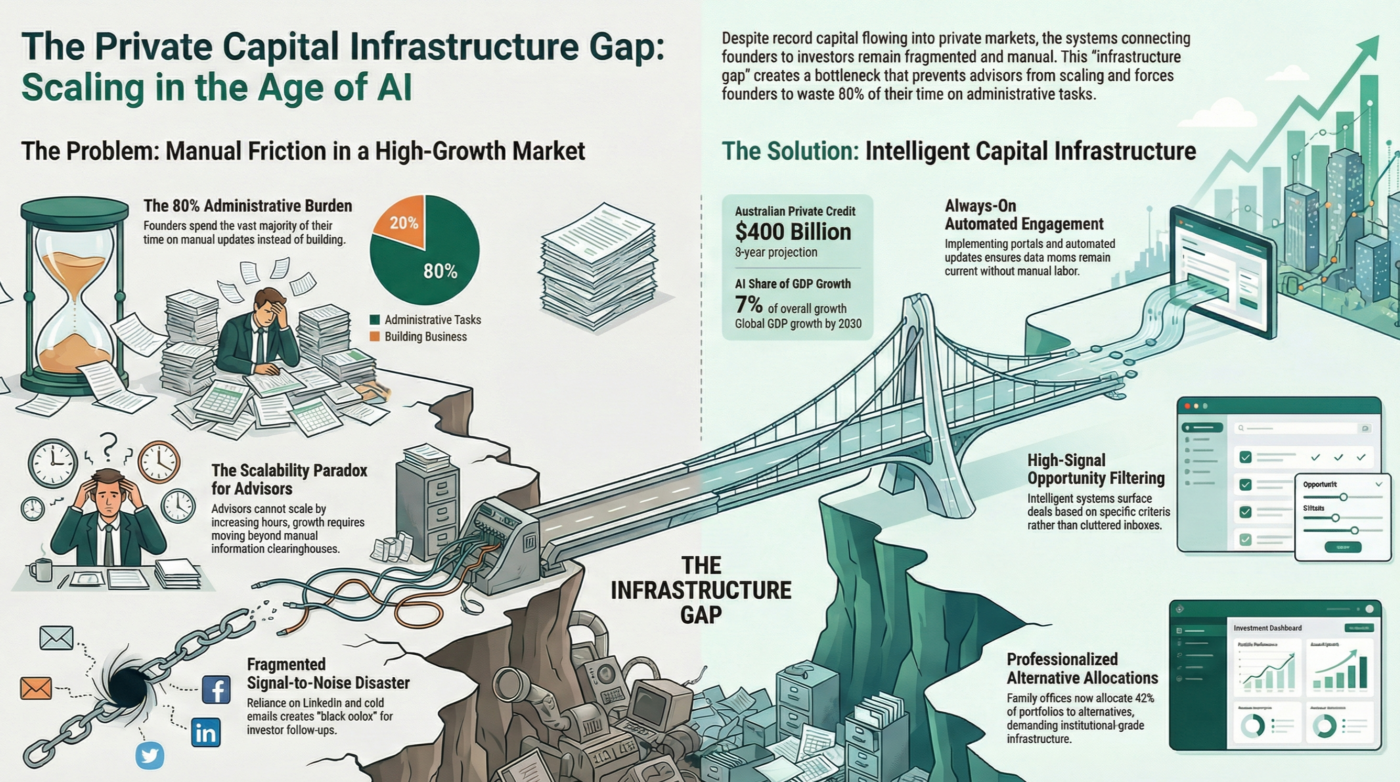

The result is a signal-to-noise disaster. Investors receive hundreds of opportunities with no filtering mechanism. Founders spend 80% of their time on administrative tasks instead of building. Advisors cannot scale because their value is tied to manual introductions.

Why the Rolodex Model Has a Hard Ceiling

Most advisors operate as human clearinghouses for information. They spend their time hand-holding founders through updates and chasing data that should be automated. This creates a paradox. The more successful an advisor becomes, the less time they have to actually advise.

The traditional advisory model does not scale. Growth requires adding headcount for every new client. You cannot build a practice by scaling hours. You can only build it by scaling infrastructure.

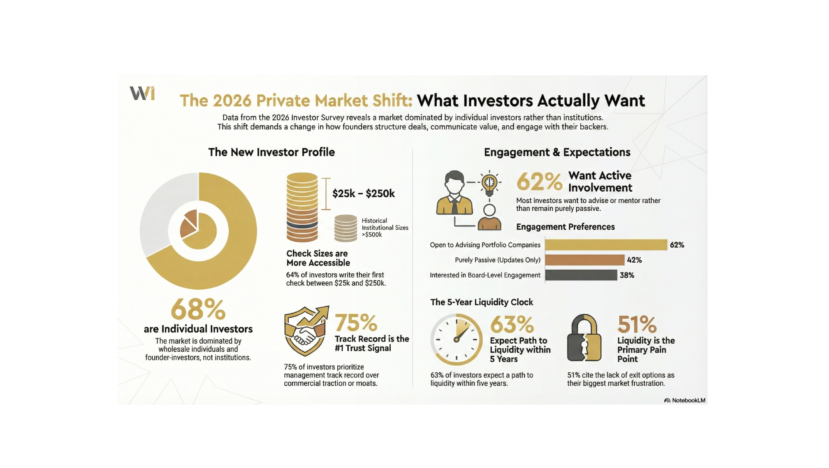

The same limitation applies to investor networks. Over 60% of private capital investors are open to strategic calls with founders. They have backgrounds in banking, finance, and go-to-market strategy. But there is no system to activate this network intelligently. LinkedIn has become unusable. Introductions are inconsistent. Deal flow is either a flood or a drought.

The Shift to Always-On Intelligent Infrastructure

The private market is professionalising. Family offices now allocate 42% of portfolios to alternatives. Private credit has grown to $224 billion in Australia with expectations to reach $400 billion. The democratisation of private assets is moving from institutions to high net worth individuals to retail investors.

This professionalisation requires infrastructure that matches institutional standards. Always-on systems that filter signal from noise. Automated investor relations that free founders to focus on execution. Networks that activate rather than sit idle.

The companies winning capital in 2026 are not the ones with the best pitch decks. They are the ones with the infrastructure to maintain consistent engagement. The investors finding alpha are not scrolling through cluttered inboxes. They are using systems that surface high-signal opportunities.

The advisors scaling their practices are not adding headcount. They are implementing infrastructure that allows them to scale expertise without scaling hours.

The Macro Context Behind This Shift

The convergence of platform technologies is creating unprecedented growth opportunities. AI, robotics, energy storage, blockchain, and multi-omics are all moving through S-curve adoption simultaneously. This has not happened since the second industrial revolution.

Global GDP growth is projected to reach 7% by the end of the decade. The largest companies are expected to reach valuations between $20 trillion and $40 trillion within 10 years. There is $2.5 trillion in potential IPOs queued for 2026.

This is the greatest window to build and invest in 30 years. But only for those with the infrastructure to capitalise on it.

The $3.5 trillion succession wave is creating massive liquidity events. Founders are looking to transition. Investors are seeking double-digit yields. Private equity firms are deploying dry powder. All of this requires efficient capital engagement infrastructure.

The old model relied on personal networks and manual processes because the deal volume was manageable. That era is over.

The Implication for Those Who Ignore This

Capital will flow to the path of least resistance. Investors will allocate to opportunities that require minimal friction. Founders will work with advisors who provide scalable value. Advisors will lose clients to platforms that offer better infrastructure.

The rolodex is no longer the moat. The system is.

Those still operating on fragmented emails and manual updates are not competing with other advisors or investors. They are competing with intelligent infrastructure that operates 24/7. The gap will widen. The winners will be decided by those who professionalise their capital engagement before the market forces them to.

The private market is moving toward efficiency. Toward systems that save time and money. Toward infrastructure that activates networks instead of letting them decay.

The question is not whether this shift will happen. It is whether you will adapt before you become irrelevant.

#PrivateCapital #VentureCapital #InvestorRelations #PrivateEquity #CapitalEngagement

Trending

Backed By Leading Investment Groups and Family Offices