News and Announcements

The Bridge Is Built: Why the NYSE’s Move Changes Capital Allocation Forever

- Published January 20, 2026 2:47AM UTC

- Publisher Steve Torso

- Categories Capital Insights, Landing, Trending

For the last five years, I have told you that the convergence of digital assets and traditional finance was not a probability. It was an inevitability.

We often look for a single moment that signals the shift from “experimental” to “institutional.”

That moment happened on January 19, 2026.

The New York Stock Exchange (NYSE) did not just announce a pilot programme. They announced a new trading venue. They are building a dedicated platform for the trading and on-chain settlement of tokenised securities.

This is the largest equities exchange in the world, telling you that the future of capital markets is on-chain.

For Family Offices and High Net Worth Individuals, this is not just technical news. It is a fundamental change in how you will manage liquidity, collateral, and capital efficiency over the next decade.

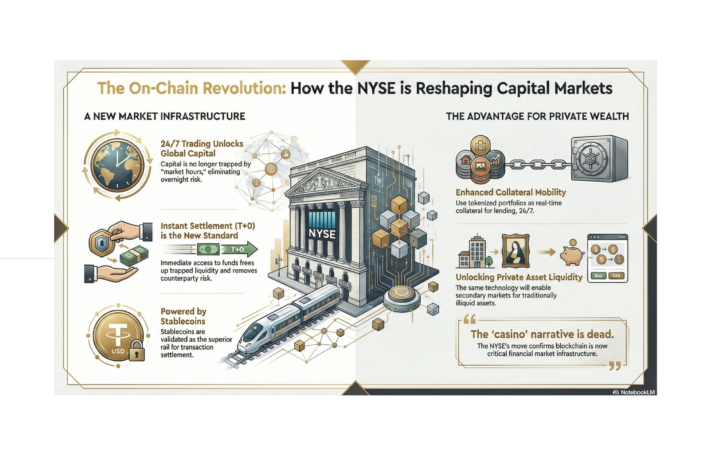

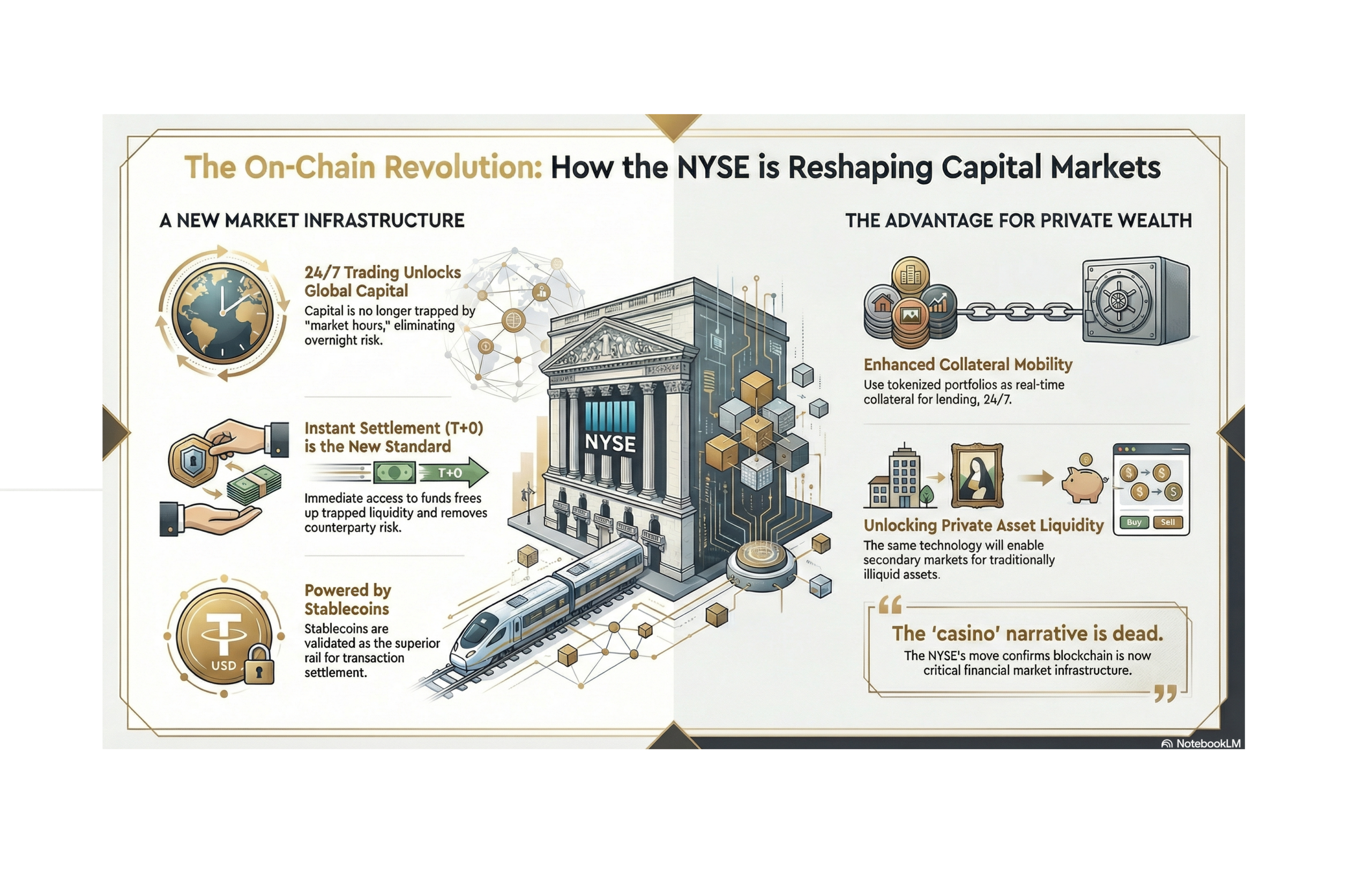

The End of “Banking Hours”

The most archaic concept in modern finance is the “market hour.”

Capital is global. Information moves instantly. Yet your ability to act on that information has been restricted to a 9:30 AM to 4:00 PM window in New York.

The new NYSE platform changes this. By leveraging blockchain rails, they are introducing 24/7 operations.

This matters because volatility does not respect time zones.

If a geopolitical event happens in Asia while New York is sleeping, your capital is currently trapped. In this new infrastructure, your ability to enter or exit positions is continuous. You are no longer taking overnight risk because the “doors are closed.”

T+0 Is The New Standard

The move from T+2 to T+1 settlement was an incremental upgrade. The move to T+0 is a structural revolution.

Settlement cycles are essentially a measure of inefficiency. They are the times your capital sits in limbo, exposing you to counterparty risk.

The NYSE platform offers instant settlement.

When you sell an asset, you have the funds immediately. For a Family Office managing significant treasury functions, this releases trapped liquidity. It allows for the immediate redeployment of capital.

This efficiency is powered by stablecoin integration. The NYSE is working with major custodians like BNY and Citi to support tokenised deposits. This confirms what we have known for a long time: stablecoins are the superior rail for transaction settlement.

Why This Matters for Private Wealth

You might ask why a change in public equities infrastructure matters to private wealth allocators.

It matters because infrastructure is agnostic.

The rails the NYSE is building for public stocks are the same rails that will eventually carry private credit, real estate, and venture capital.

We are seeing the validation of the Unified Ledger concept.

Once the regulatory frameworks and technical rails are proven with liquid public equities, the tokenisation of private assets will accelerate.

For Family Offices, this leads to three distinct advantages:

1. Collateral Mobility You will eventually be able to use your tokenised portfolio (public or private) as collateral in real-time, 24/7, without the friction of traditional paper-based lending.

2. Global Access A dollar-denominated, blockchain-based order book allows for seamless global participation. The barriers to moving capital across borders are being lowered by the technology itself.

3. The Liquidity Premium As we see with the “private credit” boom, investors are hungry for yield but wary of lock-ups. Tokenisation offers the technical capability for secondary liquidity in traditionally illiquid assets. The NYSE, which is verifying this tech for equities, gives the green light for the rest of the market to follow.

The “Casino” Narrative is Dead

For years, sceptics dismissed blockchain as a casino for retail speculators.

That narrative died this week.

When the parent company of the NYSE (ICE) builds the floor, the “casino” argument is invalid. This is now a critical financial market infrastructure.

The institutions are not coming. They are here. They are building. And they are setting the rules for the next twenty years of wealth creation.

The question is no longer if you should have a digital asset strategy. The question is whether your current infrastructure is ready to plug into this new world.

We will be unpacking the institutionalisation of digital assets and what it means for your portfolio at Emergence 2026.

This is the time to pay attention.

Trending

Backed By Leading Investment Groups and Family Offices