News and Announcements

The Convergence: Why AI and Life Sciences are the Next Trillion-Dollar Frontier

- Published January 07, 2026 6:32AM UTC

- Publisher Steve Torso

- Categories Capital Insights, Events, Landing, Trending

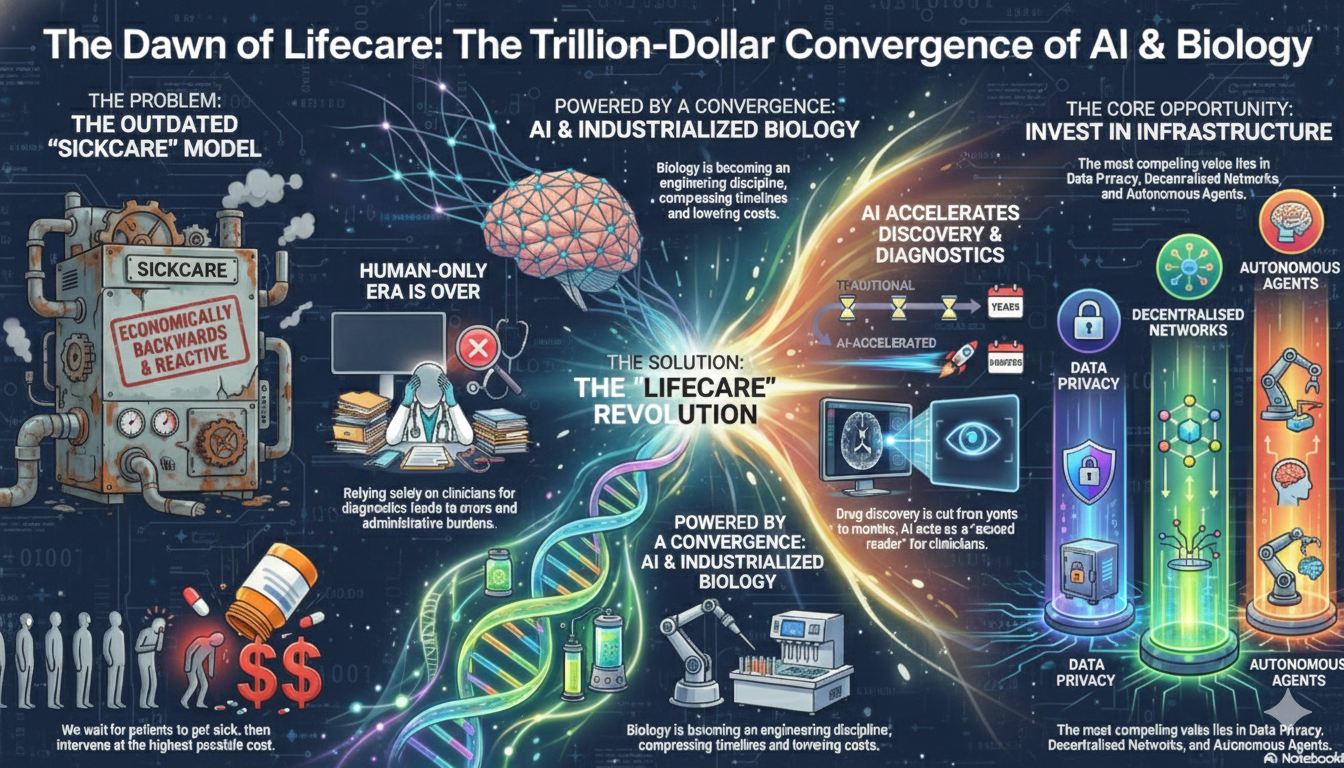

The Era of “Sickcare” is Ending

For decades, the global healthcare model has been economically backwards. We wait for systems to fail, for a patient to get sick, and then we intervene at the highest possible cost. This is “Sickcare.”

In 2026, we are finally witnessing the structural shift to “Lifecare.”

This is not a marketing buzzword. It is a fundamental economic transition driven by the convergence of two massive forces: artificial intelligence and the industrialisation of biology.

The Industrialisation of Biology

Biology is ceasing to be purely experimental and is becoming an engineering discipline.

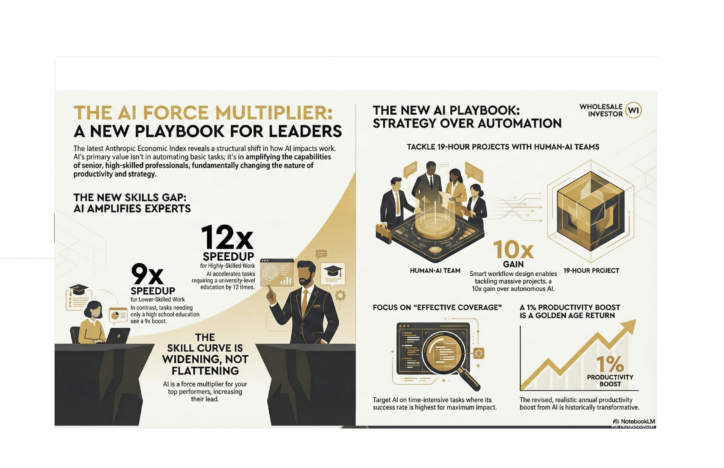

Previously, drug discovery was a lottery. It took years and billions of dollars to identify viable candidates. Today, AI is compressing those timelines from years to months. We are seeing in silico molecule design predict outcomes before a physical lab is ever touched.

This does not just lower costs. It increases velocity. It means we can target diseases that were previously economically unviable to treat.

The Rise of the “Second Reader”

In diagnostics, the “human-only” era is over. AI has established itself as the standard “second reader” in radiology and pathology. This isn’t replacing the clinician; it is augmenting them. It creates a safety net that drastically reduces error rates and orchestrates workflows so doctors can focus on patient care rather than administrative tasks.

Infrastructure is the Opportunity

For investors, the most compelling opportunities often aren’t the headline-grabbing consumer apps. They are in the infrastructure.

As we move toward proactive health monitoring, where real-time data guide wearables and supplements, the value shifts to the layers underneath.

- Data Privacy & Sovereign Identity: Who owns your biological data? Technologies such as Trusted Execution Environments (TEEs) are becoming increasingly critical.

- Decentralised Networks: Moving health intelligence out of silos and into secure, user-owned networks.

- Autonomous Agents: The “digital workforce” that will handle the administrative burden of clinical trials and hospital operations.

The Window is Now

We are at a historic convergence. The technology is ready, the regulatory environment is adapting, and the capital is moving.

This is one of the core themes we are focusing on for 2026. The founders who understand this shift aren’t just building better healthcare companies. They are building the most valuable companies of the next decade.

Join us at Emergence 2026 as we bring together the investors and founders leading this charge.

Trending

Backed By Leading Investment Groups and Family Offices