News and Announcements

The Bombora Special Investments Growth Fund delivered a positive return of 0.1% in October despite big fall in equity markets

- Published November 09, 2018 12:00AM UTC

- Publisher Wholesale Investor

- Categories Company Updates

KEY TAKEAWAYS:

- The Bombora Special Investments Growth Fund (Fund) delivered a positive return of 0.1% (net of fees) for the month

of October 2018, despite the big fall in equity markets. - Australian shares recorded their worst monthly fall since August 2015 during October, with every single sector on the benchmark index closing the month firmly in the red.

- Bombora’s aim is to maximise shareholder value in all investment opportunities and align all interests to long-term business plan execution. Bombora actively participates in all investments to help the founders and co-investors realise the growth potential of the company.

Considering the recent market volatility we also wanted to share the recent fund performance, Bombora Investment Management would like to share the October 2018 monthly update.

Australian shares recorded their worst monthly fall since August 2015 during October, with every single sector on the benchmark index closing the month firmly in the red. The All Ordinaries Price Index fell -6.5% in the month, with the ASX Small Ordinaries Accumulation Index falling -9.6%. Information technology was the worst performing sector during October, as local tech stocks followed the poor performance of their US-listed peers.

The Bombora Fund delivered this positive performance outcome despite having its single largest asset exposure to listed equities spread across 7 individual investments predominantly in the small cap technology sector. Our listed equity portion of the Fund provided positive performance stand alone. It is also worthy of note that the Fund did not have any revaluation events in any of our unlisted investments during the month to deliver the October performance. We discuss our listed equity

investment process further in the activity report later in this document.

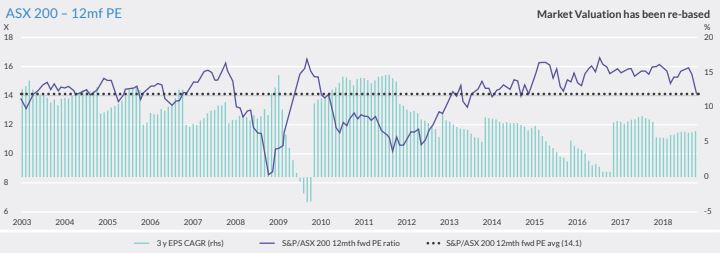

Bombora is fundamentally a bottom-up investor which looks to build a portfolio that will perform through market cycles. We remain cautiously optimistic towards the overall listed equity markets. The recent market sell-off has seen market valuations resort back to the long-term average of c.14 times forward PE. The key positive market fundamentals remain in place for quality growth companies to continue to outperform and increasingly reward high conviction investors.

Pre-IPO Investment Portfolio

UP TO 30% OF THE FUND

The Bombora Fund’s pre-IPO positions of Vamp, UltraServe and Pacific Knowledge Systems (PKS) are all performing to expectations as we actively work with the respective companies to drive growth outcomes.

We continue to experience strong deal flow of high quality new investment opportunities to review in this sector generated from our proprietary direct networks and via our far-reaching adviser and intermediary networks. We have identified 3 very interesting opportunities we are in due diligence as at 31 October.

The pre IPO position, Pacific Knowledge Systems (PKS) is in focus as we drive the business towards a planned ASX listing in the next 2 months. PKS is a profitable software business providing its product into the healthcare industry. Bombora Fund Unitholders have been provided a priority allocation to the IPO once the prospectus is launched in November 2018.

Please register your interest with Bombora if you have potential interest.

Listed Equity Investment Portfolio

UP TO 50% OF THE FUND

On the listed equity investment asset allocation we continued building positions in 7 investments and are undertaking further due diligence on a number of additional investment opportunities. The investments to date are focused across our key target sectors of software, technology, and financial services drawing from the domain expertise of the Investment team. The

positions range from microcap companies with a market capitalisation below $50M up to companies of ~$1.5B market capitalisation.

Valuation is a particularly important screen in the current market environment and as outlined earlier in this report,

stock picking and valuation discipline is likely to be a key driver of share price performance over the medium term.

The Bombora Investment Process uses multiple measures of valuation, though ultimately the accuracy of earnings forecasts is the key initial part of the analysis. We then focus on the quality of those earnings and what price is required to be paid for the forecast earnings growth. This measure is typically referred to as the Price Earnings Growth (PEG) ratio. The lower the PEG ratio, the lower the price you are being asked to pay for the earnings growth. Using a recent fund investment as an example, the PEG ratio is below 1 times (i.e. 30% p.a. earnings growth over multiple years on a PE ratio of c.20 times). While the PEG

ratio analysis may appear obvious, we believe the market continues to be inefficient in appropriately pricing growth.

Special Situation Investment Portfolio

UP TO 20% OF THE FUND

The Fund’s previously reported convertible note in a pre IPO investment opportunity continues to track positively to an ASX listing this calendar year. We look forward to providing an update in next month’s report.

In October, Bombora established and seed funded another company with the view of using this unlisted public company to acquire an operating entity and list on the ASX. This vehicle is very similar to the last 6 shells we have done, although it isn’t trading yet on the ASX, it was designed to be “IPO ready” to facilitate a transition once a new business being acquired is ready to list. The unlisted public company seed funded by the Fund is called RPro Limited (RPro), and is similar to the SPV vehicle we established and seed funded for the upcoming ASX listing of Pacific Knowledge Systems (discussed earlier in this report). Unitholders of the Bombora Fund will be offered a seed investor position in RPro.

Please register your interest with Bombora if you have potential interest.

Company Updates

Backed By Leading Investment Groups and Family Offices