Date of Report: June 3, 2025

Introduction

The Australian government is evaluating the introduction of an Unrealised Capital Gains Tax (UCGT), a policy that would tax capital gains on assets before they are sold. This proposal has raised significant concerns among investors, particularly those engaged in the renewable energy, sustainability, and life science sectors, industries vital to Australia’s economic resilience, innovation, and environmental goals. To assess the potential ramifications of this tax, a survey was conducted targeting investors and company leaders within these sectors.

This report presents a detailed analysis of the survey results, offering evidence-based insights into how the UCGT could affect investment behaviour, discourage long-term holdings, and influence critical funding mechanisms such as Self-Managed Super Funds (SMSFs). The findings aim to inform policymakers of the potential economic and sectoral consequences while amplifying the voices of the investment community.

Methodology

The survey was conducted online and distributed to a targeted audience of investors and company leaders actively involved in the renewable energy, sustainability, and life science sectors. A total of 143 responses were collected, providing a robust sample for analysis. The survey combined multiple-choice questions for quantitative data and open-ended questions for qualitative insights, ensuring a comprehensive understanding of respondents’ perspectives.

Key areas of inquiry included:

- The tax’s potential impact on investment decisions in the specified sectors.

- Its effect on the willingness to hold long-term investments in innovative companies and life sciences.

- The profile of respondents (e.g., founders or leaders with capital-raising experience).

- The role and contribution of SMSF investors in funding these sectors.

The survey’s design and distribution prioritised credibility and relevance, targeting stakeholders with direct experience in the investment landscape of these high-impact industries.

Key Findings

The survey revealed several critical insights into the potential effects of the UCGT:

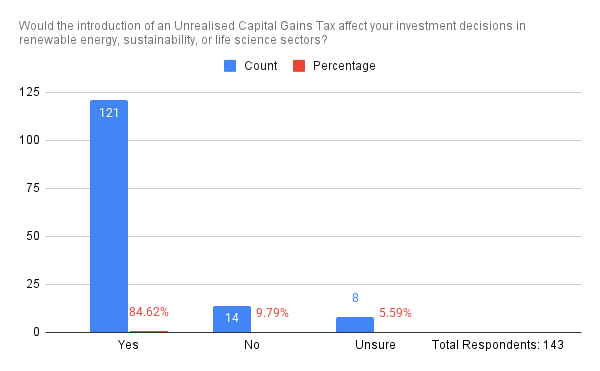

- Investment Decisions: 84.62% of respondents (121 out of 143) indicated that the tax would influence their investment choices in renewable energy, sustainability, and life sciences, signalling a broad concern across the respondent pool.

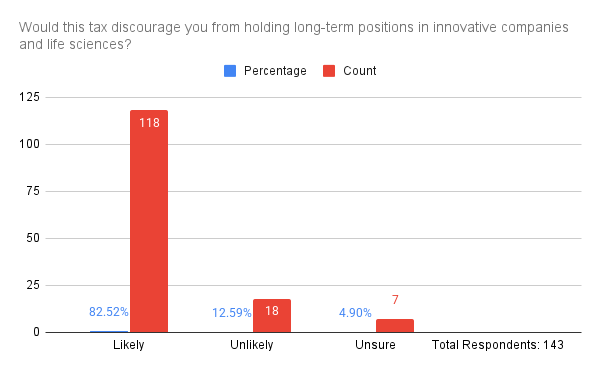

- Long-Term Investment: 82.52% (118 out of 143) believe the tax would discourage long-term investments in innovative companies and life sciences, potentially undermining growth in sectors requiring sustained capital commitment.

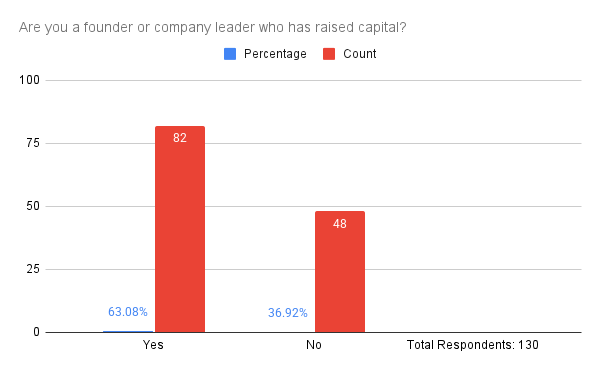

- Respondent Expertise: 63.08% (82 out of 130 respondents to this question) identified as founders or company leaders who have raised capital, reflecting a sample with significant practical experience in these industries.

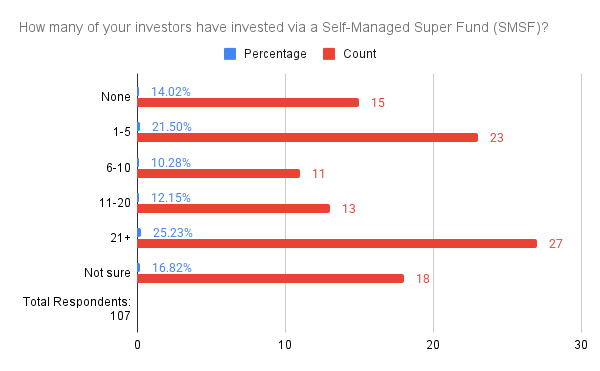

- SMSF Investor Role: SMSF investors are a key funding source, especially in early-stage investments. Notably, 64.65% of respondents reported SMSF participation at the Seed stage, and 25.23% have more than 21 SMSF investors, highlighting their substantial involvement.

These findings suggest that the UCGT could disrupt investment flows into sectors critical for Australia’s future, with implications for innovation, economic growth, and environmental sustainability.

Detailed Results

The following sections present the full survey data in a structured format, using tables to enhance clarity and precision.

Analysis: The overwhelming majority (84.62%) anticipate a shift in their investment strategies, suggesting that the tax could significantly alter capital allocation in these sectors.

Analysis: With 82.52% indicating that the tax would deter long-term holdings, there is a clear risk to the stability and growth of companies in innovative fields that rely on patient capital.

Analysis: Over 63% of respondents have direct experience raising capital, lending weight to their concerns about the tax’s impact on investment ecosystems.

Analysis: A significant 25.23% reported having 21 or more SMSF investors, and only 14.02% reported none, underscoring the prevalence of SMSF funding in these sectors.

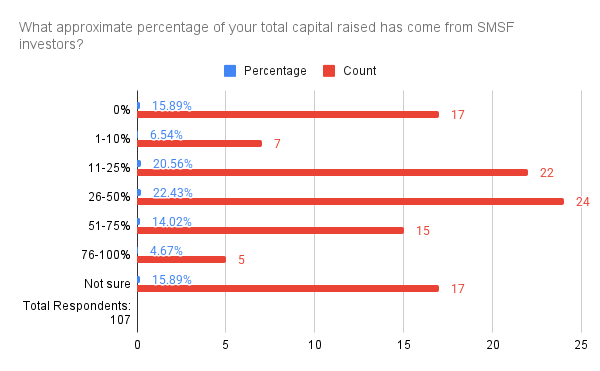

Analysis: SMSF investors contribute meaningfully to capital pools, with 22.43% of respondents attributing 26-50% of their funding to SMSFs and 14.02% citing 51-75%, highlighting their critical role.

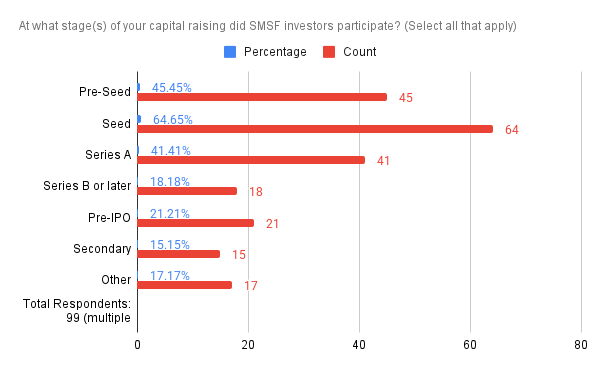

Analysis: SMSF investors are most active in early stages, with 64.65% contributing at the Seed stage and 45.45% at Pre-Seed, indicating their importance to startups and emerging companies.

Investor Feedback and Suggestions

Respondents provided valuable qualitative feedback through open-ended questions, offering insights into their concerns and proposing actionable alternatives. The feedback has been categorised into key themes:

- Concerns About Innovation and Early-Stage Investment:

- Many expressed alarm that the UCGT would reduce capital availability for startups and innovative firms, particularly in sectors with long development timelines like life sciences and renewable energy.

- Example: “This tax could stifle innovation in sectors that are critical for our future.”

- Suggestions for Exemptions or Incentives:

- Several respondents advocated for exemptions or reduced tax rates for investments in renewable energy, sustainability, and life sciences to preserve investment momentum.

- Example: “We need policies that support, not hinder, investment in sustainable technologies.”

- Calls for Comprehensive Impact Assessment:

- Investors urged the government to conduct a detailed study of the tax’s potential economic and sectoral effects before proceeding.

- Example: “A thorough impact assessment is essential to avoid unintended consequences.”

- Recommendations for Alternative Policies:

- Suggestions included tax credits, grants, or incentives for long-term investments in high-impact sectors as alternatives to the UCGT.

- Example: “The government should consider the long-term economic and environmental benefits of these investments and offer incentives instead.”

This feedback reflects a proactive stance from the investment community, seeking to balance fiscal policy with the need to foster growth in strategic industries.

Conclusion

The survey data unequivocally demonstrates that the proposed Unrealised Capital Gains Tax poses a substantial risk to investment in Australia’s renewable energy, sustainability, and life science sectors. With 84.62% of respondents anticipating an impact on their investment decisions and 82.52% expecting discouragement of long-term holdings, the tax could destabilise industries that depend on sustained capital for innovation and growth.

The significant involvement of SMSF investors—evidenced by their contributions at early stages (e.g., 64.65% at Seed) and substantial capital shares (e.g., 22.43% at 26-50%)—further amplifies the potential fallout, as these investors may retract from funding critical startups.

The qualitative feedback reinforces these quantitative findings, highlighting fears of stifled innovation and proposing viable alternatives such as sector-specific exemptions or incentives.

Given the strategic importance of these sectors to Australia’s economic and environmental future, this report urges the government to reconsider the UCGT’s implementation. A comprehensive impact assessment, coupled with dialogue incorporating investor suggestions, is recommended to ensure that fiscal policy aligns with national priorities for growth, sustainability, and innovation.

This report provides a meticulous breakdown of the survey data and stakeholder perspectives, offering a compelling case for reevaluating the proposed tax. It is submitted with the intent of fostering informed policy decisions that support Australia’s long-term prosperity.