News and Announcements

The 30-Minute First Investor Meeting: A Structured Framework That Stops Founders From Waffling

- Published February 02, 2026 10:00AM UTC

- Publisher Bella Battsengel

- Categories Capital Raising Tips

The Problem: Founders Talk Too Much

The first investor meeting determines whether there will be a second meeting. Most founders approach this conversation without structure. They waffle. They talk more than they should. They lose the investor’s attention.

After 17 years of facilitating thousands of investor conversations, the pattern is clear. Founders who approach the first meeting with a defined structure close deals faster.

Founders who “fly by the seat of their pants” extend timelines and lose momentum.

The first investor meeting is not about convincing. It is about discovering alignment. Alignment of thesis. Alignment of strategy. Alignment of expectations.

This requires a structured approach that keeps the conversation focused and efficient.

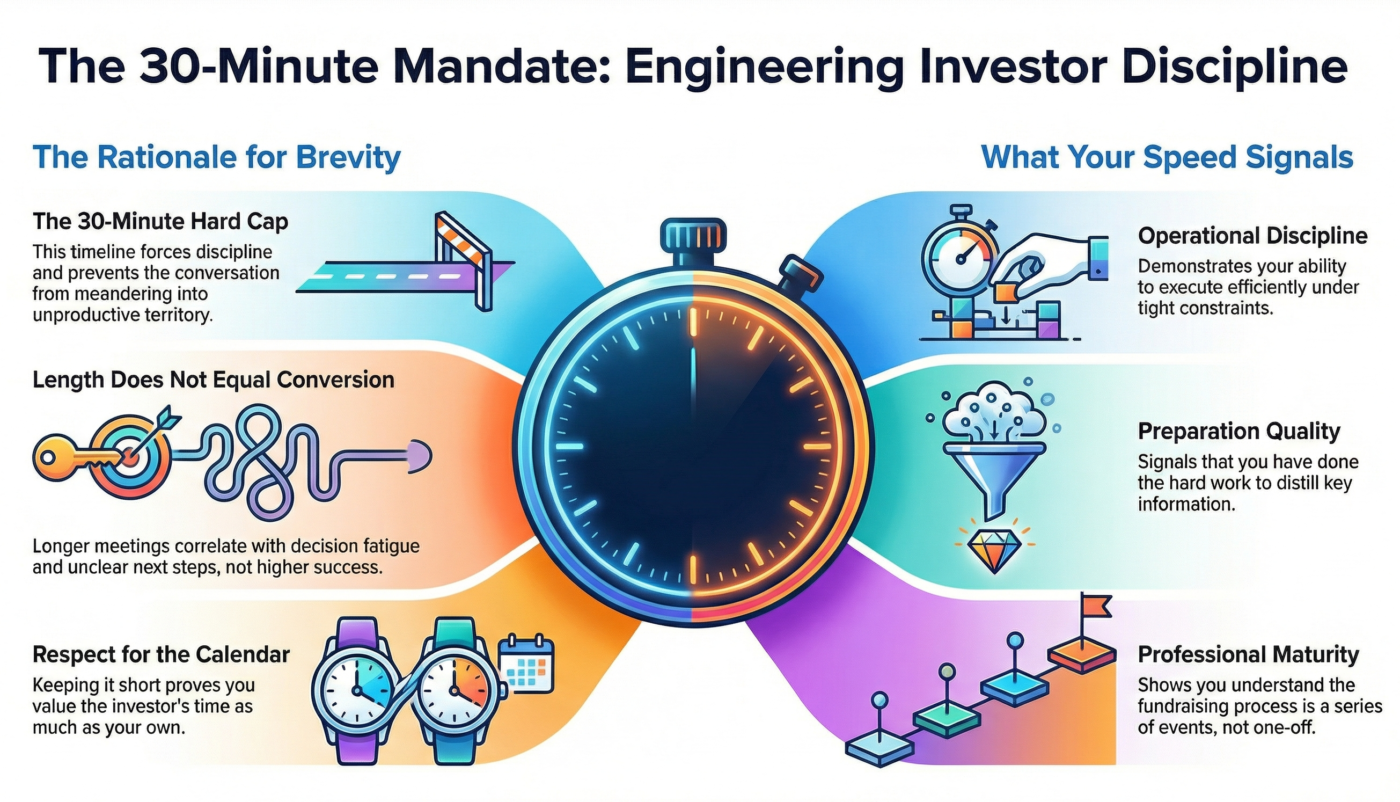

Why 30 Minutes Is the Target

The first investor meeting should not exceed 30 minutes. This timeline forces discipline. It respects the investor’s time. It prevents the conversation from meandering into unproductive territory.

Longer meetings do not correlate with higher conversion rates. They correlate with unclear next steps and decision fatigue.

What 30 Minutes Communicates

- Operational discipline. You can execute efficiently under constraints.

- Respect for time. You value the investor’s calendar as much as your own.

- Preparation quality. You have done the work to distill key information.

- Professional maturity. You understand this is a process, not a single event.

Investors evaluate founders on operational signals. Meeting structure is one of those signals.

The Agenda Framework: Four Parts in Sequence

The first investor meeting follows a predictable structure. Opening with an agenda sets expectations and maintains control of the conversation.

Opening (2 minutes)

Pleasantries. Brief exchange. Build rapport. Do not extend this beyond 1-2 minutes.

Agenda statement. “I appreciate you expressing interest in our company. For this call, I want to outline the agenda. First, I would like to understand your background and the types of opportunities you typically invest in. Second, I am happy to answer any questions you have after reviewing our documents and FAQ. Third, I will walk through our three key growth drivers, major milestones, and exit scenarios. The call should take about 30 minutes. Does that work for you?”

This agenda statement accomplishes multiple objectives. It sets the timeline expectation. It clarifies what will be covered. It positions you as organised and prepared.

Part 1: Understanding the Investor (10 minutes)

The first third of the meeting focuses entirely on the investor. This is discovery, not pitching.

What You Need to Discover

- Thesis alignment. What do they already know about your business and sector? What is their perspective on the problem you are solving?

- Opportunity assessment. What do they believe is the size of the opportunity? Does their view align with yours?

- Investment history. Have they invested in similar companies in your sector? What amounts do they typically deploy?

- Investment style. Are they active or passive investors? Do they seek board seats? What is their value-add beyond capital?

These questions are not interrogation. They are exploration. You are discovering whether this investor is the right fit for your business.

Why Thesis Alignment Matters More Than Capital

Capital raising is fundamentally about alignment of thesis. You have a thesis for your business opportunity. The investor has their own thesis.

If these theses align, investment follows naturally. If these theses diverge, no amount of pitching will close the gap.

What Thesis Alignment Looks Like

You believe the market is shifting toward X behavior. The investor agrees and has seen this pattern in other portfolio companies.

You believe your solution addresses a structural inefficiency. The investor has experienced this pain point personally or through their network.

You believe the competitive moat is Y. The investor agrees that Y is defensible and has seen similar moats succeed.

When thesis alignment exists, the conversation flows. Questions are strategic, not skeptical. The investor is already mentally modeling how you fit their portfolio.

What Thesis Misalignment Looks Like

You believe the market is large. The investor believes the market is niche.

You believe your product is a vitamin (nice-to-have). The investor only funds painkillers (must-have).

You believe growth will come from customer acquisition. The investor believes retention is the primary driver.

When thesis misalignment exists, the conversation becomes adversarial. Questions are challenges, not clarifications. No amount of data will bridge the fundamental disagreement.

Discovering this misalignment in the first meeting saves months of wasted effort.

The Investment History Question

Asking whether the investor has backed similar companies serves multiple purposes.

Why This Question Matters

- Experience validation. Do they understand your sector, or are you educating them from scratch?

- Portfolio conflict check. Are they already invested in a direct competitor?

- Check size calibration. Do their typical investments match your raise amount?

- Value-add assessment. Can they provide strategic guidance based on prior experience?

The way you ask this question matters. It should not feel like interrogation. It should feel like mutual discovery.

Example phrasing: “Have you invested in other fintech companies or marketplace businesses? I am curious about your perspective on the sector based on your portfolio experience.”

This opens the door for them to share insights without feeling pressured to disclose confidential information.

Part 2: Investor Questions (8 minutes)

The second part of the meeting is free reign for the investor to ask questions. This is where you identify what concerns them most.

What Their Questions Reveal

- Diligence depth. Did they review your FAQ and data room, or are they asking basic questions?

- Focus areas. Are they asking about market size, competition, unit economics, or team?

- Investment stage. Are they asking early-stage questions (product-market fit) or growth-stage questions (scaling efficiency)?

- Risk tolerance. Are they focused on downside protection or upside potential?

The questions an investor asks tell you what they value. Listen carefully. Take notes. This information shapes your follow-up strategy.

How to Handle Questions You Cannot Answer

Do not fabricate answers. Do not waffle. Do not promise to “get back to them” and then delay.

Effective response: “That is a great question. I do not have that data immediately available, but I can get that to you within 24 hours. Let me make a note of that.”

Then actually deliver within 24 hours. This demonstrates operational discipline and responsiveness.

Part 3: The Three Growth Drivers (8 minutes)

The third part of the meeting is where you present your strategic vision. Not your entire pitch deck. Just the three key growth drivers.

Why Three Growth Drivers

Three is enough to demonstrate strategic clarity. More than three dilutes focus. Fewer than three suggests limited growth levers.

The three growth drivers should answer one question: How does capital deployment translate into business value?

What Growth Drivers Look Like

- For revenue-generating businesses: Customer acquisition channel, retention/expansion, and product roadmap.

- For technical businesses: Data accumulation, regulatory approval, and partnership development.

- For marketplace businesses: Supply-side acquisition, demand-side growth, and platform liquidity.

Each growth driver should have a clear metric attached. Not vague aspirations. Concrete targets.

Example: “Our first growth driver is enterprise customer acquisition. We currently have 12 enterprise customers generating $1.2M ARR. With this raise, we will hire two enterprise sales reps, targeting 30 enterprise customers and $3M ARR within 12 months.”

This level of specificity demonstrates that you have modeled how capital translates to growth.

The Inflection Points That Change Valuation

After presenting growth drivers, identify 2-3 key milestones that will significantly impact valuation.

What Qualifies as an Inflection Point

- Regulatory approval. FDA clearance, financial services license, patent grant.

- Revenue milestone. Crossing $1M ARR, $5M ARR, profitability.

- Strategic partnership. Distribution deal with major player, technology integration, co-development agreement.

- Market validation. Proof of concept with tier-1 customer, referenceable case studies, industry award.

These inflection points help investors understand the risk-reward profile. They can model how valuation will evolve as you hit milestones.

How to Present Inflection Points

Current state: “We are pre-revenue with working prototype.”

- Inflection point 1: “First paying customer validates product-market fit. Target: 3 months.”

- Inflection point 2: “$500K ARR demonstrates repeatable sales motion. Target: 9 months.”

- Inflection point 3: “$2M ARR enables institutional Series A fundraising. Target: 18 months.”

This progression shows that you understand how investors evaluate de-risking over time.

Exit Scenarios: The Conversation Investors Want But Do Not Initiate

For years, discussing exits was taboo in venture capital. That stigma has evaporated. Investors now actively want to understand exit pathways.

Why Exit Scenarios Matter

Investors are not buying your business. They are buying a future exit opportunity. They need to model how they will realise returns.

Articulating realistic exit scenarios demonstrates that you think like an investor, not just a builder.

What Exit Scenarios Look Like

- Strategic acquisition. “Companies like [Competitor A] and [Competitor B] have acquired similar businesses in our space at 5x-7x revenue multiples. Recent comparable exits include [Example 1] and [Example 2].”

- IPO pathway. “Our target market size and growth trajectory align with recent IPOs like [Company X]. We would pursue public listing once we reach $50M ARR with 30%+ growth rates.”

- Private equity exit. “PE firms like [Firm Y] actively consolidate our sector. Once we reach $10M EBITDA, we become an attractive platform acquisition.”

These scenarios do not need to be commitments. They need to be plausible based on market comps.

The Discipline: Do Not Go Beyond 30 Minutes

The hardest part of this framework is self-discipline. Founders want to keep talking. They want to address every possible objection. They want to ensure the investor has all information.

This impulse kills momentum.

Why Stopping at 30 Minutes Works

- Creates scarcity. The investor wants more information, not less. This drives them to the second meeting.

- Prevents fatigue. Both parties stay engaged. Attention does not drift.

- Forces prioritisation. Only the most important information gets shared. Everything else goes to follow-up.

- Demonstrates confidence. You are not desperate to convince. You are evaluating mutual fit.

If the conversation naturally extends because the investor is asking strategic questions, that is fine. But do not let it extend because you are filling silence with unnecessary detail.

The Close: Setting Up the Second Call

The final minute of the meeting is critical. Do not end with “Let me know if you have more questions.” End with a concrete next step.

How to Close the First Meeting

- Summarise alignment. “It sounds like we are aligned on the market opportunity and the strategic approach. I appreciate you sharing your perspective.”

- Acknowledge next steps. “I assume you will want to review our data room more thoroughly and potentially speak with some of our customers or advisors.”

- Propose timeline. “Does it make sense to reconnect in about a week? That gives you time to do deeper diligence, and I can address any additional questions that come up.”

- Confirm commitment. “I will send a calendar invite for next [day] at [time]. Does that work for you?”

This close removes ambiguity. There is a defined next step. There is a timeline. There is mutual commitment.

What to Have in Front of You During the Call

This framework only works if you have the structure documented in front of you during the call. Do not rely on memory.

The One-Page Meeting Script

- Agenda items (checkbox list to ensure you cover everything)

- Investor discovery questions (the 5-6 questions you want to ask)

- Three growth drivers (one-sentence description + key metric for each)

- 2-3 Inflection points (milestone + timeline + impact)

- Exit scenarios (2-3 pathways with comparable examples)

- Follow-up items (space to note questions you need to answer post-call)

This one-page script keeps you on track without sounding robotic. You are not reading from it. You are referencing it to ensure nothing gets missed.

Why This Framework Stops Waffling

Founders waffle because they lack structure. They are anxious. They want to fill silence. They think more talking equals more convincing.

The opposite is true.

What Waffling Signals to Investors

- Lack of preparation. If you cannot structure a 30-minute call, how will you structure business operations?

- Unclear thinking. Rambling indicates you have not distilled your strategy to core elements.

- Insecurity. Over-explaining suggests you lack confidence in the business fundamentals.

- Poor time management. If you cannot respect a 30-minute boundary, how will you manage investor updates and board meetings?

The structured framework eliminates waffling by giving you a roadmap. You know what to cover. You know when to stop. You stay focused.

The Follow-Up: What Happens After the First Meeting

The first meeting ends with a scheduled second meeting. The period between these meetings is where most founders lose momentum.

What to Do in the Week Between Meetings

- Send thank-you email within 2 hours. Brief. Professional. Confirms second meeting time.

- Deliver promised information within 24 hours. Any questions you could not answer in the meeting.

- Update data room. If the investor identified missing documents, add them immediately.

- Prepare for deeper questions. The second meeting will go deeper on specific areas of concern.

- Do not chase. If you set a second meeting, trust the process. Excessive follow-up signals desperation.

This disciplined follow-up reinforces the operational professionalism you demonstrated in the first meeting.

Common Mistakes Founders Make in First Meetings

Even with this framework, founders make predictable mistakes that kill momentum.

Mistake 1: Starting With the Pitch

The investor has already reviewed your materials. Do not repeat the pitch deck verbatim. Discovery first, presentation second.

Mistake 2: Answering Questions They Did Not Ask

Founders over-answer. An investor asks about customer acquisition cost. The founder launches into a 10-minute explanation of the entire marketing stack.

Answer the question asked. Stop. Let them ask follow-ups if they want more detail.

Mistake 3: Avoiding Difficult Questions

If an investor asks about competitive threats or unit economics challenges, do not deflect. Address it directly. Credibility comes from acknowledging risks, not ignoring them.

Mistake 4: Failing to Ask About Investment Timeline

Investors operate on different timelines. Some can move in weeks. Others need months for committee approvals.

Ask directly: “What does your typical investment process look like from first meeting to term sheet?”

This information helps you manage expectations and prioritise which investors to focus on.

The Implication: Structure Equals Professionalism

Capital raising is not a mysterious art. It is a structured process. The first investor meeting is the foundation of that process.

Founders who approach it with a defined framework demonstrate operational maturity. They respect the investor’s time. They discover alignment efficiently. They set up productive second meetings.

Founders who “wing it” extend timelines, lose investor attention, and fail to close deals.

The market is separating into two categories. Founders with professional capital raising infrastructure and founders without.

The gap between these categories is widening. The only question is which one you are in.

#InvestorMeetings #CapitalRaising #FounderAdvice #StartupFundraising #InvestorRelations #PitchStrategy

Capital Raising Tips

Backed By Leading Investment Groups and Family Offices