News and Announcements

Elanor Hotel Accommodation Fund

- Published June 09, 2022 12:00AM UTC

- Publisher Wholesale Investor

- Categories Company Updates

Elanor Hotel Accommodation Fund well positioned for growing demand for regional and luxury accommodation

Demand for domestic tourism has grown significantly following the easing of all COVID restrictions and an increased awareness of Australian tourism destinations. Regional and luxury accommodation hotels are benefiting from this structural shift in demand.

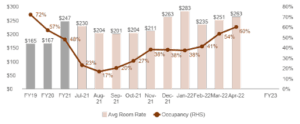

The Elanor Hotel Accommodation Fund’s (EHAF) portfolio of regional and luxury accommodation hotels is well positioned to benefit from this structural shift in demand. EHAF’s portfolio is experiencing a strong recovery in occupancy with average daily room rate now approximately 60% higher than pre-COVID levels.

Hotels can provide a hedge against inflation due to their short daily ‘lease’ terms whereby room rates can be reset frequently. Luxury and upscale hotels enjoy the most benefit from this dynamic, which is where the majority of the Fund’s portfolio is targeted.

Elanor’s end-to-end hotel investment platform, with in-house hotel operations management, is generating a sustainably high Average Room Rate – significantly above pre-COVID levels. As occupancy recovers following the end of COVID restrictions, the Fund is very well positioned to generate strong investment returns.

Register your interest in Elanor Hotel Accommodation Fund

Hotels can provide a hedge against inflation due to their short daily ‘lease’ terms whereby room rates can be reset frequently. Luxury and upscale hotels enjoy the most benefit from this dynamic, which is where the majority of the Fund’s portfolio is targeted.

Elanor’s end-to-end hotel investment platform, with in-house hotel operations management, is generating a sustainably high Average Room Rate – significantly above pre-COVID levels. As occupancy recovers following the end of COVID restrictions, the Fund is very well positioned to generate strong investment returns.

Click here to hear from Elanor’s Hotels, Tourism and Leisure Team

The Offer

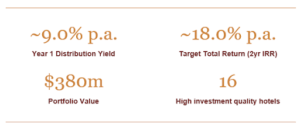

The Fund is in the final stages of securing the acquisition of Estate Tuscany Hunter Valley (“Hunter Valley”) and Sanctuary Inn Tamworth “(Tamworth”) for a total acquisition price of $29.2 million.

The Hunter Valley and Tamworth properties are high investment quality accommodation hotels located in key regional NSW tourism destinations. Both acquisitions have been negotiated ‘off-market’. The hotels will further enhance the geographic diversification of the EHAF portfolio and will also deliver significant operational synergies once integrated into Elanor’s in-house hotel operations platform (given their respective markets and regional NSW locations).

The acquisition of these regional accommodation assets will result in the Fund’s portfolio value increasing to $379.9 million.

Applications for this opportunity are due by 5pm on Friday, 17 June 2022.

Funds are due by 5pm on Thursday, 23 June 2022.

Register your interest in Elanor Hotel Accommodation Fund

Company Updates

Backed By Leading Investment Groups and Family Offices