Events

Why Life Sciences Is Now One of My Highest Conviction Investment Themes

In 17 years, we’ve watched themes rise and fall. Today, life sciences is a portfolio-defining opportunity. This is not speculation; it is pattern recognition based on the staggering returns from companies like Telix and Neuren, and the convergence of AI, clear regulatory pathways, and a shift in capital back toward real science.

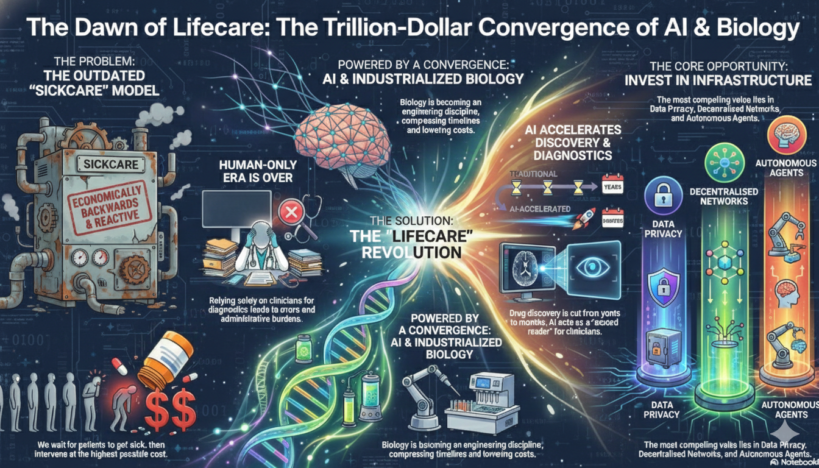

The Convergence: Why AI and Life Sciences are the Next Trillion-Dollar Frontier

The global healthcare model is undergoing a fundamental economic transition, moving from expensive ‘Sickcare’ to proactive ‘Lifecare.’ This shift is powered by the convergence of artificial intelligence and the industrialisation of biology, creating massive, compelling investment opportunities in infrastructure and redefining the future of health.

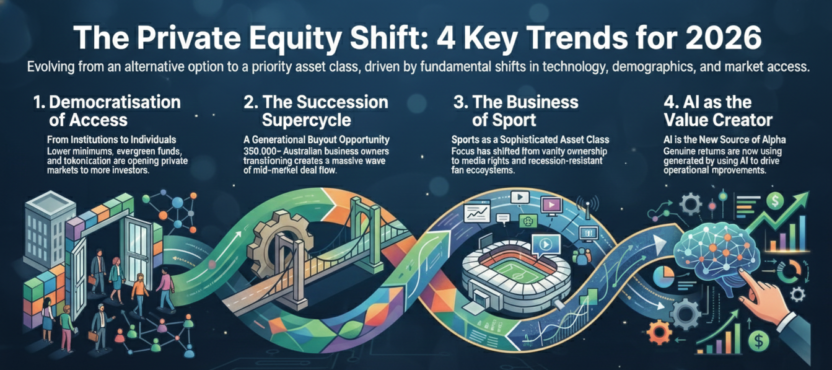

The Private Equity Shift: What Smart Money is Positioning For in 2026

Private equity is now the priority allocation target for institutions in 2026. This fundamental shift is driven by a convergence of technology and demographic changes, creating four major investment trends: the democratisation of access, the succession supercycle, the rise of sports as an asset class, and AI-driven operational improvement.

The System’s Immune System: Why Big Tech Will Solve What Big Pharma Can’t

The central investment thesis for the future of human health pits Big Pharma against Big Tech. This blog post explores the “Protocol Paradox” in current cancer care and argues that the convergence of hyperscalers and life-science experts—treating biology as a data and compute problem—represents the defining compounding investment opportunity of this era.

The Life Sciences Supercycle: Why Australian Biotech is Finally Delivering Billion-Dollar Outcomes

Australia’s life sciences sector is experiencing an unprecedented “Supercycle,” finally commercializing world-class research into global, billion-dollar businesses. Learn about the ASX heavyweights, the key drivers (AI, institutional execution, FDA pathway), and the investment opportunity at Emergence 2026.

Navigating the Future of Capital: Insights from MENA’s VC and PE Leaders

The venture capital and private equity landscape in the MENA (Middle East and North Africa) region is experiencing dynamic shifts, driven by rapid technological advancements, evolving investor demands, and unique regional priorities. A recent panel featuring prominent figures in the MENA investment scene offered a glimpse into these transformations, highlighting key trends for founders and […]

Web3’s Maturing Landscape and Trillion-Dollar Opportunities

The narrative around Web3 is rapidly evolving. While many still associate it primarily with the speculative highs and lows of cryptocurrencies, the reality is a rapidly maturing ecosystem brimming with genuine innovation and significant investment potential. As Steve Torso, Co-founder & Managing Director of Wholesale Investor & CapitalHQ, aptly puts it, “It’s only got 8% […]

The Deal is Done. Now What? Navigating the Founder’s Void After an Exit

Beyond the financial transaction, selling a business often leaves founders grappling with a “void”—a profound loss of identity and purpose. This article explores these post-exit challenges and advocates for a holistic plan to achieve true, fulfilling success after the sale.

The Founder’s Void: What Happens the Day After You Sell?

Selling a business can leave a profound sense of emptiness, known as “The Founder’s Void.” This post explores this often-overlooked emotional aftermath and provides strategies for founders to redefine purpose and embrace new opportunities post-sale.

Backed By Leading Investment Groups and Family Offices