Capital Insights

The Private Equity Shift: What Smart Money is Positioning For in 2026

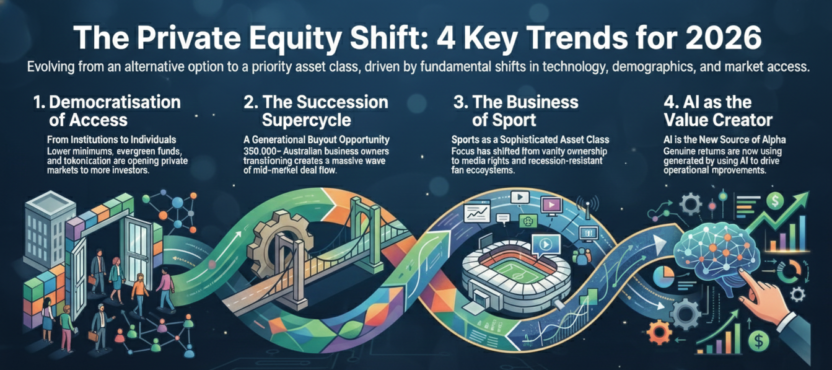

Private equity is now the priority allocation target for institutions in 2026. This fundamental shift is driven by a convergence of technology and demographic changes, creating four major investment trends: the democratisation of access, the succession supercycle, the rise of sports as an asset class, and AI-driven operational improvement.

The “Crypto Cycle” is Dead. The Infrastructure Era is Here.

The digital asset market is transitioning from an era of speculation to institutionalisation. The traditional “4-year Halving Cycle” is broken, as smart money focuses on building the rails for the future of finance, driven by Macro Liquidity, Real World Assets (RWA) tokenisation, and Stablecoins as the global settlement layer.

The Great Corporate Collapse of 2026: Why Ford Surrendered and the Innovator’s Dilemma

Corporate Collapse, Innovator’s Dilemma, Ford, Electric Vehicles, EV, Hybrids, Tesla, BYD, Digital Transformation, AI, Technology, Compute, Sheep Effect, Legacy Systems

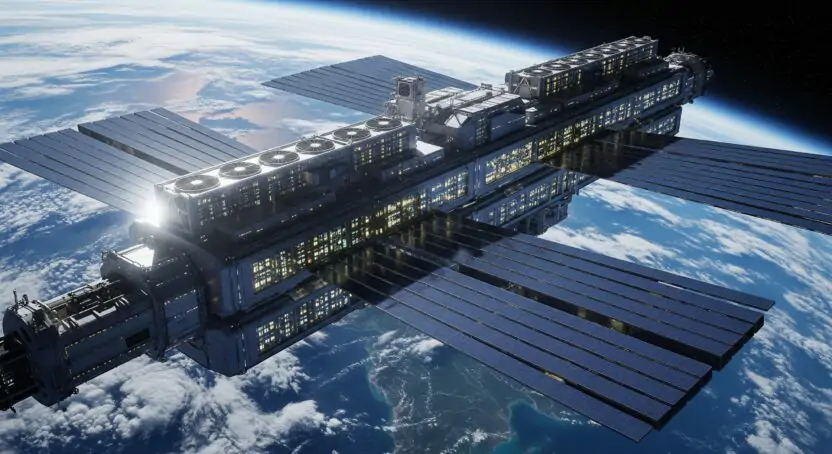

The Decoupling of Compute: Why the Next Infrastructure Trade isn’t on Earth

The convergence of the Earth-bound energy crisis and unprecedented AI demand is forcing a dramatic infrastructure shift. Learn why the world’s tech titans are pioneering orbital data centers, driven by superior energy efficiency and cooling in the vacuum of space.

The RBA Just Validated the Shift to Private Credit

With the RBA’s latest decision confirming the ‘higher for longer’ environment, sophisticated investors are rotating capital from rate-sensitive public markets into private credit for superior, lower-volatility yields. The era of cheap money is over, making private credit a necessary multi-year positioning decision.

The System’s Immune System: Why Big Tech Will Solve What Big Pharma Can’t

The central investment thesis for the future of human health pits Big Pharma against Big Tech. This blog post explores the “Protocol Paradox” in current cancer care and argues that the convergence of hyperscalers and life-science experts—treating biology as a data and compute problem—represents the defining compounding investment opportunity of this era.

The Life Sciences Supercycle: Why Australian Biotech is Finally Delivering Billion-Dollar Outcomes

Australia’s life sciences sector is experiencing an unprecedented “Supercycle,” finally commercializing world-class research into global, billion-dollar businesses. Learn about the ASX heavyweights, the key drivers (AI, institutional execution, FDA pathway), and the investment opportunity at Emergence 2026.

Following the Billions: Where the Hyperscalers are Betting on the Future

The roadmap for the next decade isn’t hidden in pitch decks—it’s written on the balance sheets of Microsoft, Amazon, and Google. Their collective investment is flowing into three key areas: GPU Chips, AI Factories, and Energy. This foundational buildout signals a $7–$20 trillion economic convergence, where the physical race for infrastructure and energy is paramount. The article also covers the powerful macro case for digital assets in this new era.

The Great Re-Allocation: Why AI is Forcing Smart Money From Software to Hard Science

Smart money is rapidly shifting its investment focus from commoditized software to hard science and deep tech, as AI dissolves traditional software moats. Discover the dual pressure on investors and the pivot to businesses with durable, real-world defensive barriers.

Backed By Leading Investment Groups and Family Offices