Capital Insights

Crypto is the winner in the US Election!

The 2024 US election has marked a turning point for cryptocurrency, with both political parties offering bipartisan support, significant donations from the crypto community, and a focus on regulatory clarity. As the industry gains more legitimacy and influence, crypto has become a key player in shaping future economic policies.

122% Returns: The Aussie Crypto Fund Outperforming Bitcoin

In the ever-shifting world of cryptocurrency investments, one fund has made waves by consistently outperforming its peers. This fund has demonstrated a remarkable ability to navigate the volatility of the digital asset market while delivering impressive returns. By employing a combination of strategic risk management, selective investing, and benchmarking against Bitcoin, Merkle Tree Capital has […]

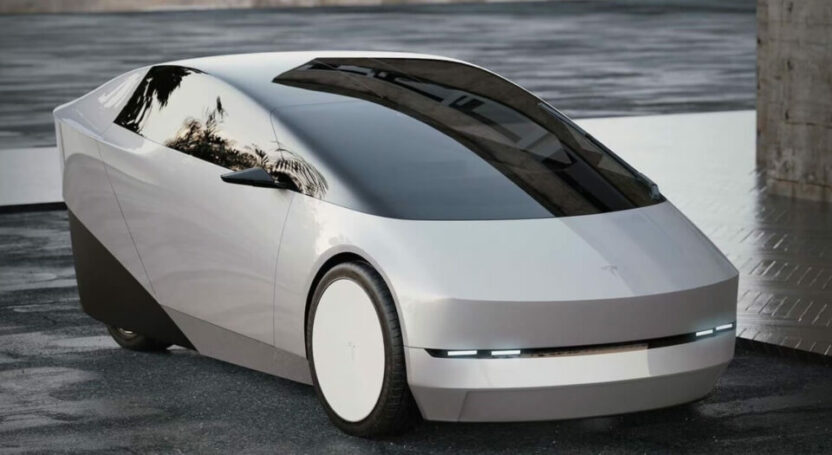

Tesla’s Leap into the Future: A Convergence of Technology and Revenue-Generating Mobility

Tesla’s latest prototypes—the Cybertaxi, Robovan, and Optimus Robot—represent a transformative leap in autonomous technology. With AI-driven mobility solutions and cutting-edge energy storage, Tesla is poised to reshape transportation, logistics, and revenue models for both consumers and investors. Explore the potential impact of this groundbreaking evolution.

Sub-Scale M&A: A Market on the Rise

The market for sub-scale mergers and acquisitions is booming in Australia, driven by affordable growth opportunities, a need for liquidity, and abundant available capital. This trend presents new opportunities for both buyers seeking cost-effective growth and founders exploring exit pathways.

The Changing Landscape of Capital Raising: Key Insights from the Cut Through Venture Quarterly Report

The Q3 2024 Cut Through Venture Report highlights key trends shaping the capital raising environment, including a sharp decline in funding, a growing focus on secondary exits, and a shift toward profitability. Explore how startups and investors are navigating these changes and what it means for the future of venture capital.

Why Australia’s Mid-Market is a Goldmine for Investors

Australia’s mid-market and SME lending sector presents a significant, untapped opportunity for investors. Causeway Asset Management, led by Tim Martin, focuses on filling the funding gap by offering tailored private debt solutions with attractive risk-adjusted returns. With a proven track record, diversified portfolio, and expert risk management, Causeway is capitalizing on this underserved market, delivering strong returns for investors while supporting Australia’s economic backbone.

How Does the World Change After October 10? The Introduction of the Tesla Robotaxi

This October, the world of transportation takes a pivotal turn as Elon Musk and Tesla gear up to unveil what could redefine urban mobility: the Tesla Robotaxi. Set against the cinematic backdrop of Warner Bros. Studio in LA, this event promises more than just a reveal; it’s a glimpse into the future of autonomous travel. […]

The Timing and Impact of AI in Business: Insights from Tim Trumper’s Keynote

In a recent keynote at our Digital Asset, AI and Technology Conference, Tim Trumper delivered a thought-provoking presentation on the transformative role of AI in the business landscape, particularly highlighting how AI is set to redefine the future of work, investment, and corporate strategy. Key Takeaways: Why This Matters For both investors and business leaders, […]

AI Trends Reshaping Business in 2024: A Guide for High-Net-Worth Investors and Family Offices

As we navigate through 2024, artificial intelligence (AI) continues to revolutionize the business landscape. Explore the most impactful AI trends, from AI bots and co-pilots to enterprise solutions and text-to-video advancements.

Backed By Leading Investment Groups and Family Offices