Capital Insights

The $3.5 Trillion Succession Wave: Why 48% of Australian Business Owners Are About to Destroy Value

Australia’s Largest Wealth Transfer Has No Exit Plan Australian business succession planning is broken. An estimated $3.5 trillion in assets will pass from Baby Boomers to younger generations over the next two decades. The numbers reveal a crisis. 48% of Baby Boomer business owners plan to exit within five years. Only 24% have formal succession […]

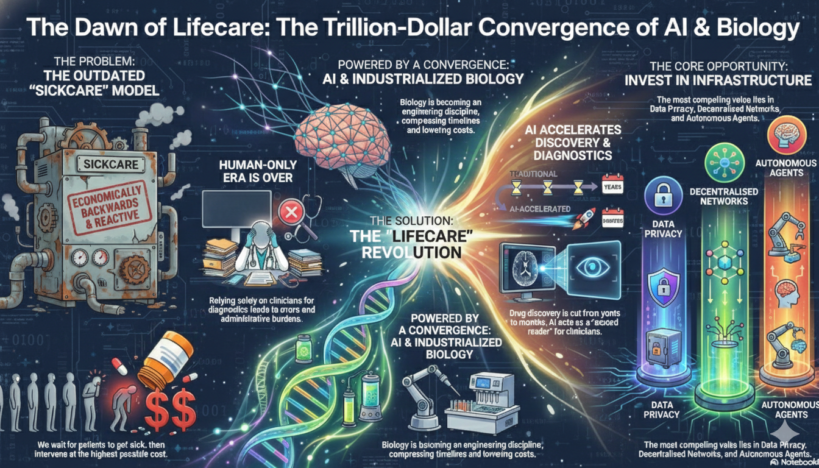

The Great Life Science Reset: Why the “Sick Care” Model is Failing

The data reveals a significant transition: the end of the traditional sick care model and the rise of a proactive healthcare ecosystem. Learn how smart money is utilising AI to cut drug discovery times in half, transform diagnostics to detect complex diseases in days, and create efficiencies to scale the healthcare system without a proportional increase in costs.

Australia’s A$4 Trillion Generational Pivot

Australia’s wealth management landscape is undergoing a dramatic transformation. For decades, family offices operated quietly during the “Great Moderation”, an era characterised by low volatility, cheap capital, and global economic synchronisation. Today, that stability has given way to fiscal uncertainty, geopolitical tensions, and intensifying regulatory scrutiny. Yet amid this global turbulence, Australia has emerged as […]

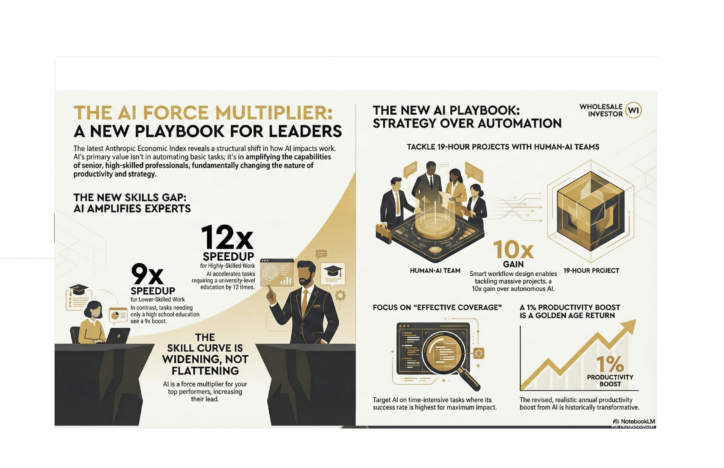

Anthropic Economic Index: Why the “Skills Gap” is About to Explode

The latest Anthropic Economic Index warns that AI is not a leveller for junior staff but a force multiplier for senior engineers, accelerating the skills gap. The transition requires a focus on workflow design and redesigning roles around where the 12x leverage actually exists.

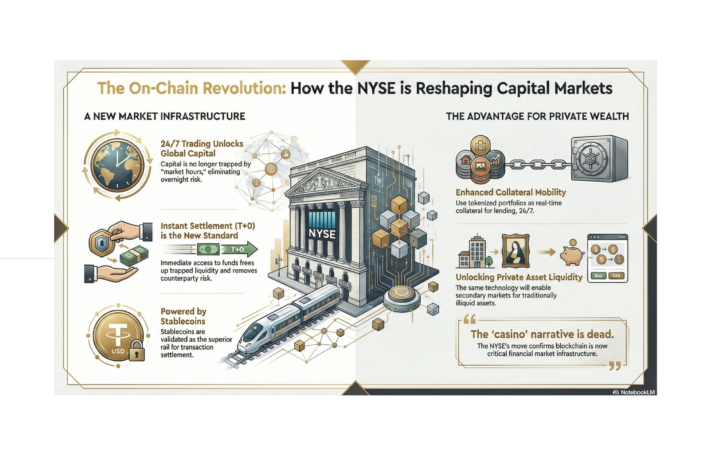

The Bridge Is Built: Why the NYSE’s Move Changes Capital Allocation Forever

The New York Stock Exchange has fundamentally changed the future of finance by announcing a dedicated platform for the trading and on-chain settlement of tokenised securities. This pivotal move signals the institutionalisation of digital assets, bringing 24/7 operations, instant (T+0) settlement, and new advantages for private wealth allocators.

Why Life Sciences Is Now One of My Highest Conviction Investment Themes

In 17 years, we’ve watched themes rise and fall. Today, life sciences is a portfolio-defining opportunity. This is not speculation; it is pattern recognition based on the staggering returns from companies like Telix and Neuren, and the convergence of AI, clear regulatory pathways, and a shift in capital back toward real science.

The GPS for Oncology: Ending the era of ‘blind’ cancer removal

Ferronova is pioneering the “GPS for Oncology” with magnetic nanoparticles, creating a high-definition roadmap to precisely trace cancer in lymph nodes and eliminate the guesswork of traditional surgery, a move from “search and destroy” to “trace and target.”

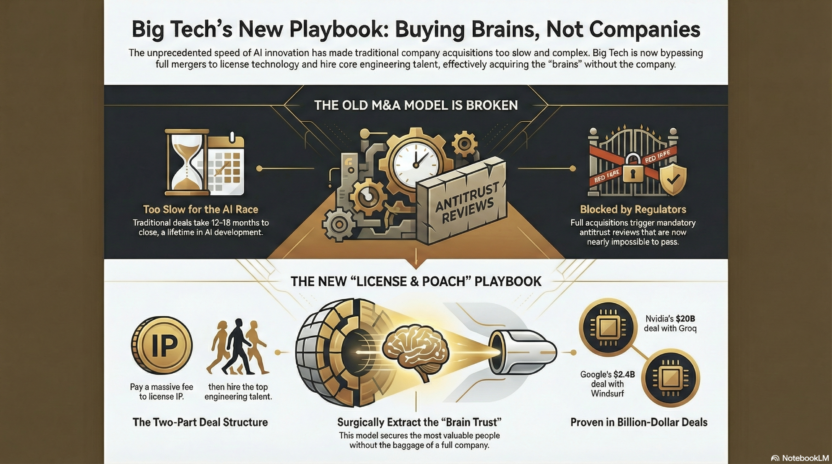

The Shift: Why Big Tech Stopped Buying Companies and Started Buying Brains

The unprecedented speed of AI innovation has triggered a structural shift in how Big Tech consolidates power. The era of the full company acquisition is pausing, replaced by a new model: buying brains and renting IP through rapid, high-value licensing deals and surgical talent extraction that sidesteps regulatory hurdles.

The Convergence: Why AI and Life Sciences are the Next Trillion-Dollar Frontier

The global healthcare model is undergoing a fundamental economic transition, moving from expensive ‘Sickcare’ to proactive ‘Lifecare.’ This shift is powered by the convergence of artificial intelligence and the industrialisation of biology, creating massive, compelling investment opportunities in infrastructure and redefining the future of health.

Backed By Leading Investment Groups and Family Offices