News and Announcements

Capital Raising 3.0: Unveiling the Future of Venture Investment

- Published May 31, 2023 11:00PM UTC

- Publisher Wholesale Investor

- Categories Capital Insights, Capital Raising Tips

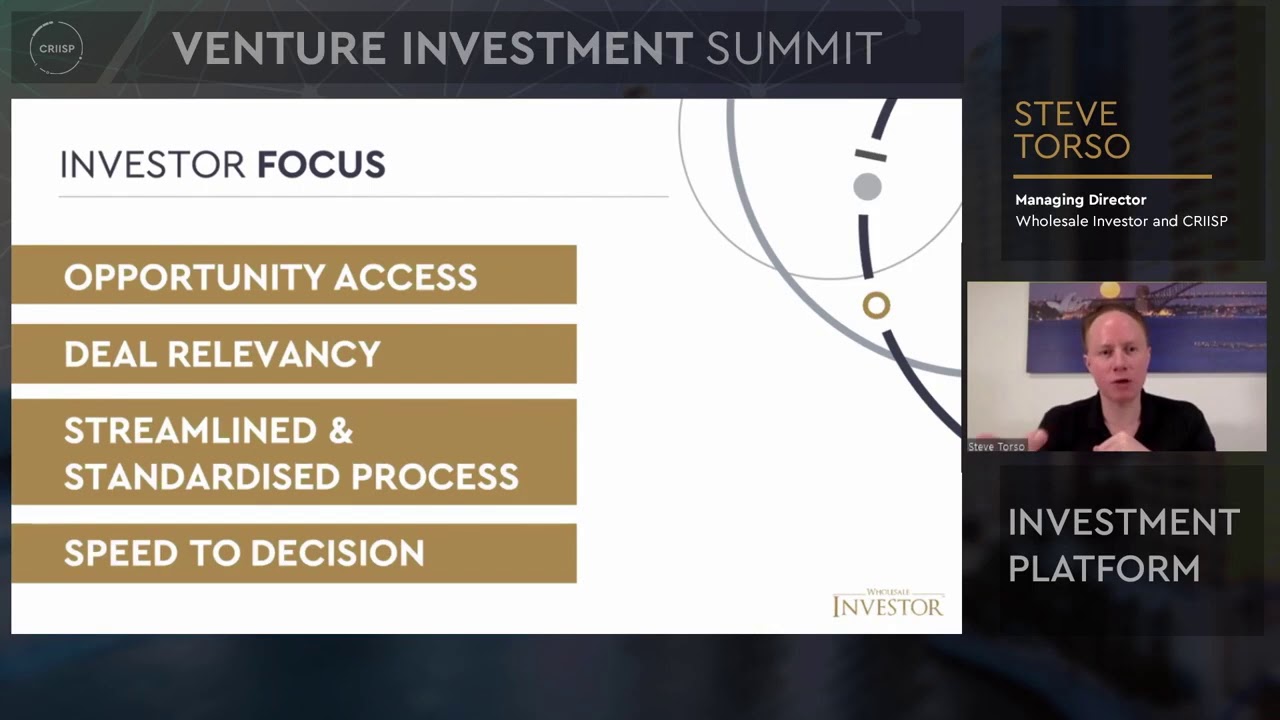

Discover the future of venture investment with Capital Raising 3.0. Join us in this engaging presentation as we delve into the history of capital raising, explore the key focus areas of the innovative Capital Raising 3.0 approach, and highlight how Wholesale Investor leverages its experience in funding companies.

Throughout the years, the landscape of capital raising has evolved, and Capital Raising 3.0 represents the next chapter in this dynamic journey. Gain valuable insights into the changing dynamics and emerging trends that shape the future of venture investment.

Our presentation explores the core principles and strategies of Capital Raising 3.0, providing you with a comprehensive understanding of the key elements that drive success in modern capital raising efforts. We share real-world examples and lessons learned from the companies that Wholesale Investor has supported, offering practical knowledge and actionable advice for entrepreneurs and investors alike.

Don’t miss this opportunity to stay ahead of the curve and navigate the ever-changing world of venture investment. Join us for an informative and thought-provoking session on Capital Raising 3.0 and unlock the potential for growth and success in your capital raising endeavors.

Capital Raising Tips

Backed By Leading Investment Groups and Family Offices