News and Announcements

A Typical LP Composition In A Venture Fund

- Published December 14, 2022 8:39AM UTC

- Publisher Osama Hassan

- Categories Capital Raising Tips

Do you know what the hardest part of a VC’s journey is?

It’s raising capital for the venture fund itself.

Founders – take note – you’re not the only ones out there raising capital …

Let’s continue our journey of understanding the inner workings of VCs …

VCs depend on limited partners (LPs) for capital.

Welcome to the world of LPs!

In this universe, you’ll find a range of institutional investors like:

Foundations,

University Grants,

Super/Pension Funds,

Fund of Funds,

Family Offices, and

Sovereign Wealth Funds

Each one has different sources of capital, investment criteria, constraints and return expectations.

Just as smart founders choose the right VCs and investors on their cap table, the best fund managers pick LPs that matter, can add value and shape their journey.

The best ones build rich, collaborative, two-way networks.

To achieve their target returns LPs – institutional investors – have to constantly juggle with different types of assets of which VC is one kind.

Let’s talk about asset classes in another post …

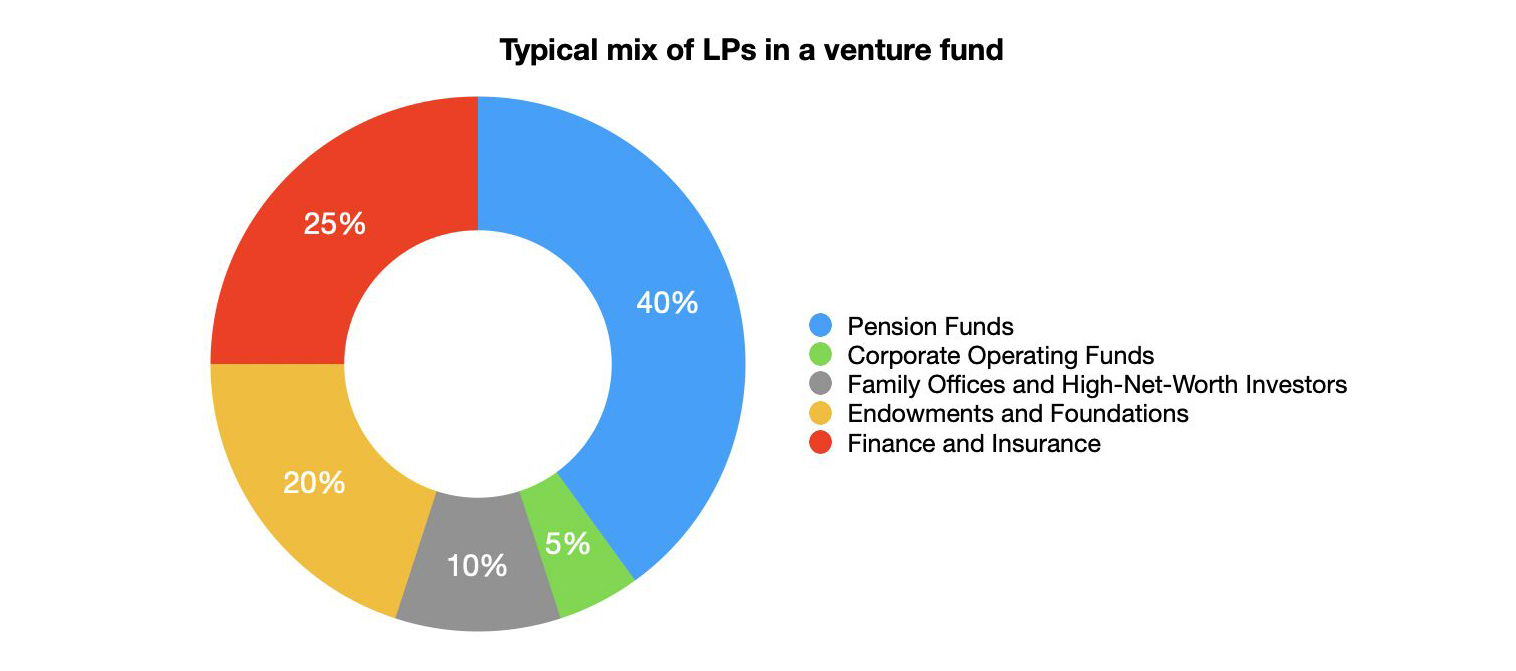

For now, here’s a chart that outlines the typical mix of LPs in a venture fund.

✌️

Click here to view the original Linkedin post.

Looking for a platform to raise capital? Click here to discover how Wholesale Investor can help you.

Your capital engagement platform

With a 14-year track record, a network of 32,000+ investors, and a capital raising platform, Wholesale investor is a leading investment platform for start-ups, scale-ups, emerging growth companies, and small caps.

Capital Raising Tips

Backed By Leading Investment Groups and Family Offices