News and Announcements

Asset Management 101 For Founders

- Published December 15, 2022 4:50AM UTC

- Publisher Osama Hassan

- Categories Capital Raising Tips

Understanding the basics of asset allocation, risk diversification and risk-reward trade offs can explain why VC funding dries up in tough market conditions 💡

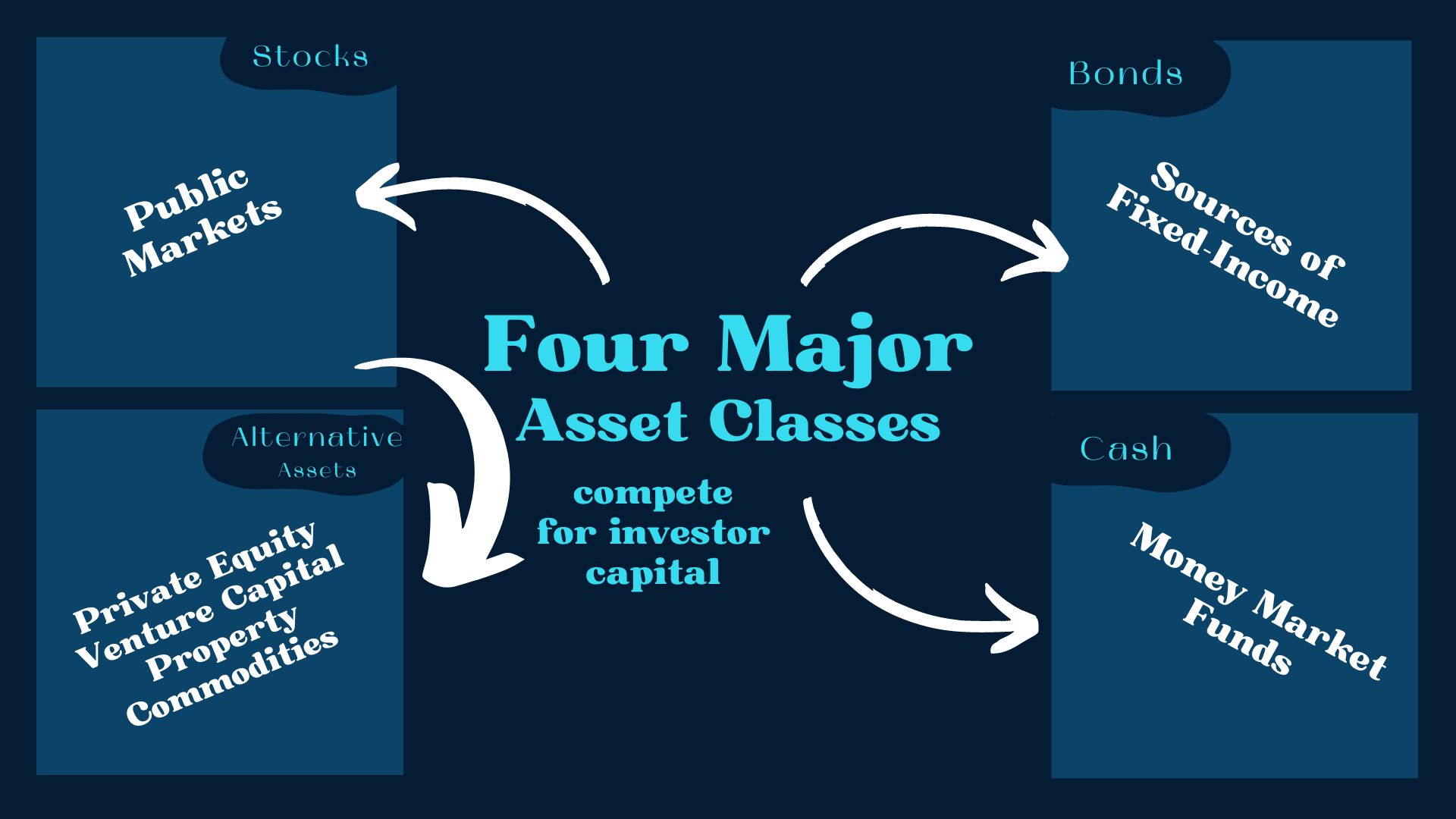

You see … multi-billion dollar institutional funds sprinkle money in different asset classes to meet asset allocation and diversification demands 💰

Each asset class has risk associated with it and each offers different financial returns …

Venture capital is actually a sub-asset class of private equity and falls under the alternative investment asset class, and for most LPs (the parties that fund VCs), it’s only a smaller fraction of the overall portfolio 🗒️

Because of risk-reward trade-offs not all asset classes are equal for investors, and because venture capital is the riskiest of them all, in trying times they will shift the allocation of their capital to reduce risk.

To make more informed decisions, essential knowledge of foundational financial concepts can really help founders better understand the economic factors behind the surplus and deficit of capital in markets 🚀🚀🚀

Click here to view the original Linkedin post.

Looking for a platform to raise capital? Click here to discover how Wholesale Investor can help you.

Your capital engagement platform

With a 14-year track record, a network of 32,000+ investors, and a capital raising platform, Wholesale investor is a leading investment platform for start-ups, scale-ups, emerging growth companies, and small caps.

Capital Raising Tips

Backed By Leading Investment Groups and Family Offices