News and Announcements

Income2Wealth announces $2,681,942 distributions paid in July 2022

- Published September 15, 2022 12:00AM UTC

- Publisher Wholesale Investor

- Categories Company Updates

The Results Are In & They’re Strutting Their Stuff!

Financial fitness never looked so good!

Our Armchair Investment Managed Funds are kicking off July 2022 financially fit & fabulous with an incredible:

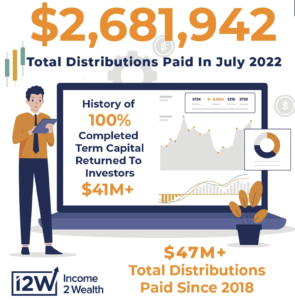

- $151M+ Funds Currently Under Management

- $2,681,942 Distributions Paid in July 2022

- $47M+ in Total Distributions paid since 2018

- 100% Completed Term Capital returned to investors totalling $41M+

If your financial fitness is looking like it has been hibernating on the couch this winter binge-watching Netflix, then what better first step than to put down the remote and get it in shape by investing your personal, business of Self-Managed Superannuation funds into our regulated Managed Fund investments?

With superior returns ranging from 8% – 20% p.a. paid monthly, a choice of investment term lengths and offers starting from an investment amount of $5,000, there’s an option for every financial fitness level.

Call us on 1800 600 890 to find out how we can get your finances in shape and looking fabulous in no time at all (and just quietly, without a lot of sweat & effort!)

Connect with the company and learn more about House of Raglan by accessing their deal room here.

Company Updates

Backed By Leading Investment Groups and Family Offices